When Earth Day comes around, it’s a good time to think about saving paper. But saving trees and doing good for the planet aren’t the only benefits of using less paper at your dealership.

If you’re using dealer software, you’re already familiar with the digital efficiency of submitting credit apps to multiple lenders with a click, accurately crunching deal numbers, signing deals on devices, or cutting down the wait for trade-in title release. But digital solutions also remove hassles associated with paper workflows and make your daily tasks easier to manage. Here’s how:

1. You can’t get a paper cut from a mobile device

Does anyone really enjoy printing and collating paper documents? It’s a lot of work and even when you do everything right, you’ll be presenting them to customers who immediately envision a case of writer’s cramp on the horizon when they just want to take their new vehicle and go.

If you made an error? Then you must start over and use up more time and paper.

And let’s not forget what those reams of paper cost! Record Nations estimates that the average business spends as much as $8,000 a year on paper.

Digital submission of credit apps and contracts can be handled on a tablet, so you don’t need to juggle stacks of paper to collect the information and signatures you need. No paper cuts, no writer’s cramp – just fast, efficient processes that help keep car buyers engaged in the excitement of their purchase.

2. We all remember the great toner explosion of 2019…

Printers and copiers can go from being useful tools to messy, annoying hindrances in an instant. Paper jams, the inability to connect to a data source, and mishaps replacing ink or toner cartridges can lead to frustrating downtime and delays for customers. Copiers and printers require expensive, often proprietary supplies, and service maintenance calls are even more costly. And printing checks often requires special equipment and more paper handling with mailing and stamps.

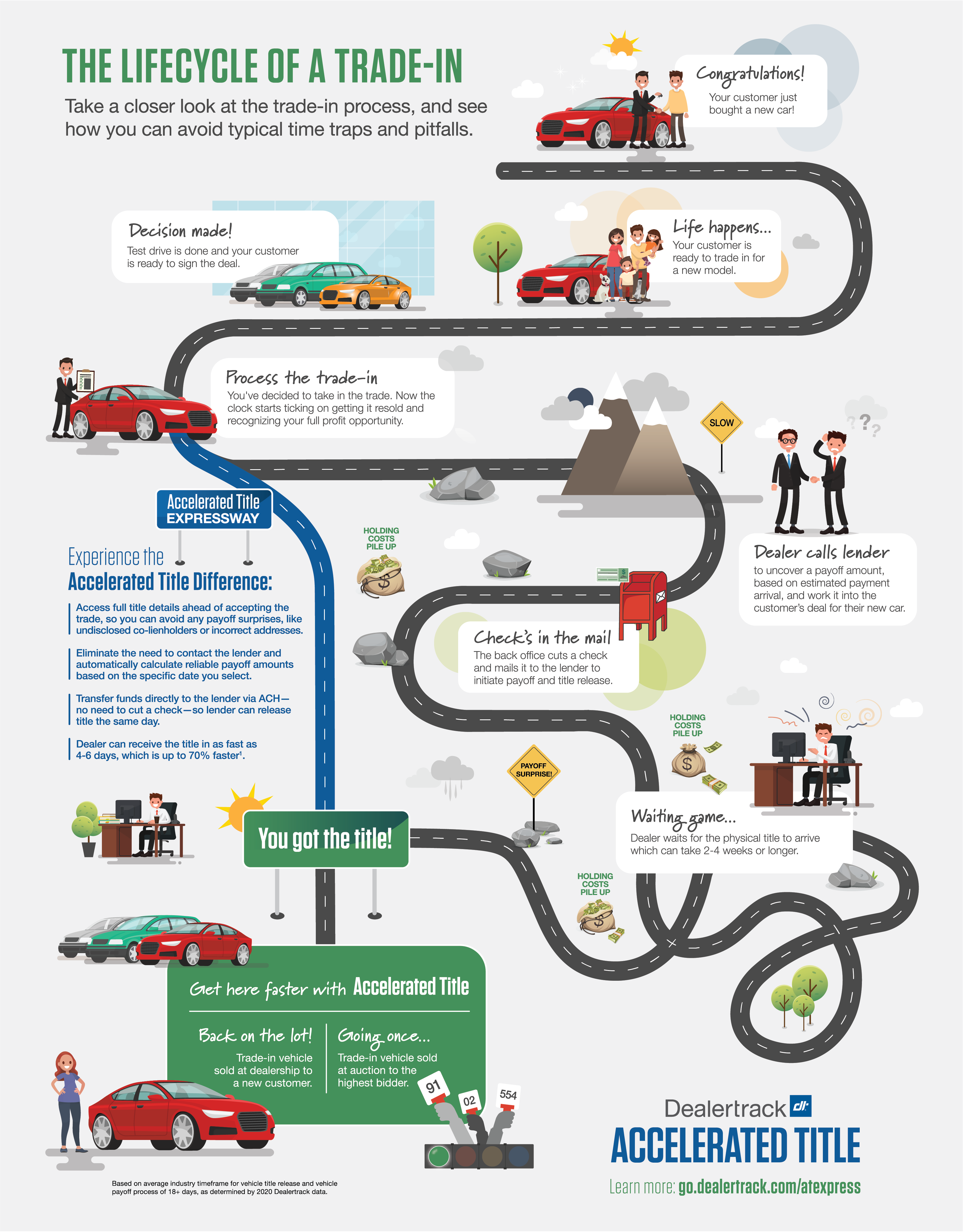

With digital processes, the war with printers is over. Online solutions allow you to submit credit apps, build funding packages, get electronic signatures, transfer trade-in payoffs via ACH, and connect securely to lenders – with no need to involve paper documents.

3. Valuable time and real estate

Did you know that a four-drawer file cabinet takes up an average of 9 square feet of floor space? That sounds like the beginning of an algebra problem, but think about what else your dealership could put in place of all the paper files you currently store.

Gartner research shows that every day, between 2% to 5% of an organization’s files are lost or misplaced. It takes an average of 18 minutes for an employee to locate a paper file and for misplaced files, the time spent jumps up to two hours! In contrast, digital files are securely stored in a customer’s digital deal jacket for easy, on demand access.

4. Keeping data out of the wrong hands

Speaking of secure storage, mishandling paper documents and files can compromise data security and expose your customers’ personally identifiable information (PII). For instance, if you forget to pick up a document from the copier or leave it out on your desk, anyone could pick it up and potentially misuse the information printed on it.

Digital solutions help keep your files password protected and available only to authorized staff members. And electronic transactions are encrypted and more secure than mailing or shipping paper documents, so sensitive customer data stays protected throughout the deal.

5. No need to get up

It’s easy for a customer to miss a signature in the haze of colorful sticky flags on stacks of paper forms. With digital signing, customers can review and sign once on a tablet or mobile phone, then simply click to apply the rest of the necessary signatures. They can do it on the lot, in the showroom, sitting in the vehicle they’re about to buy, or even handle deal completion from their home or office.

Dealerships can create full funding packages with an eContracting solution for uploading stips and deal documents, adding signature and date fields to create eSignable forms, and set up secure, single signing sessions for their customers wherever it’s most convenient for them.

6. Share and share alike

Waiting for another team to finish up with a paper folder and then having to track it down can really bog down your workflow. When you share folders digitally, it’s an automatic boost for team productivity and collaboration.

Streamlined workflows and easy access to information empower employees to work more efficiently and get more done without all the waiting around and digging through stacks of paperwork.

The bottom line

Switching to digital processes can save you up to $50 per deal on average1 – and approximately 52 sheets of paper per deal.2 Don’t let the inefficiency of paper deals impact your business – start adopting more digital credit applications, digital contracts, and electronic trade-in payoffs so you can maximize your savings!

Dealertrack has digital solutions to help reduce paper throughout your deal processes. Let us show you how. Get started >

1Savings estimates based on $50 savings from printing, shipping, and forms costs. Figures based on dealer calculations using Dealertrack’s Digital Contracting Calculator as of 2022. Not a guarantee of savings.

2Based on Dealertrack and dealer customer data as of August 2022