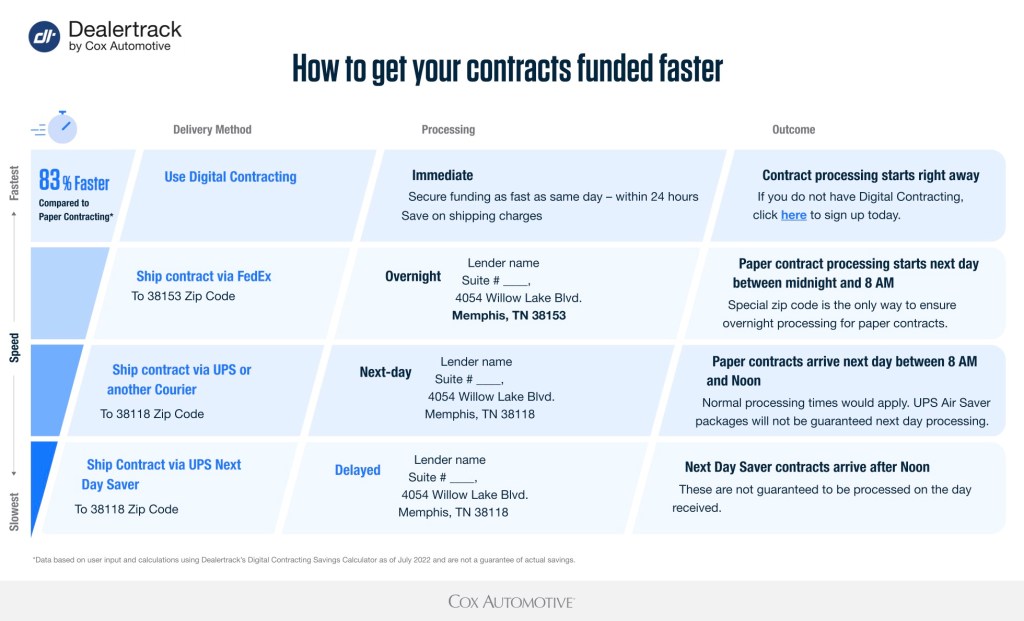

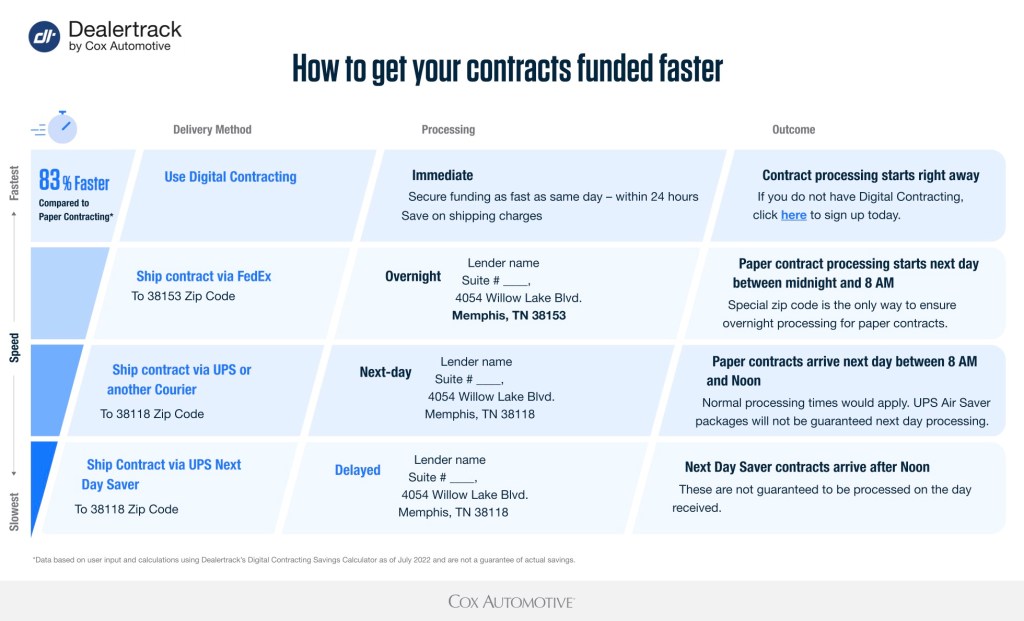

Reference this document to ensure the best method is used across your dealership to ensure paper contracts are processed as fast as possible to speed funding.

How to Get your Contracts Funded Faster

Reference this document to ensure the best method is used across your dealership to ensure paper contracts are processed as fast as possible to speed funding.

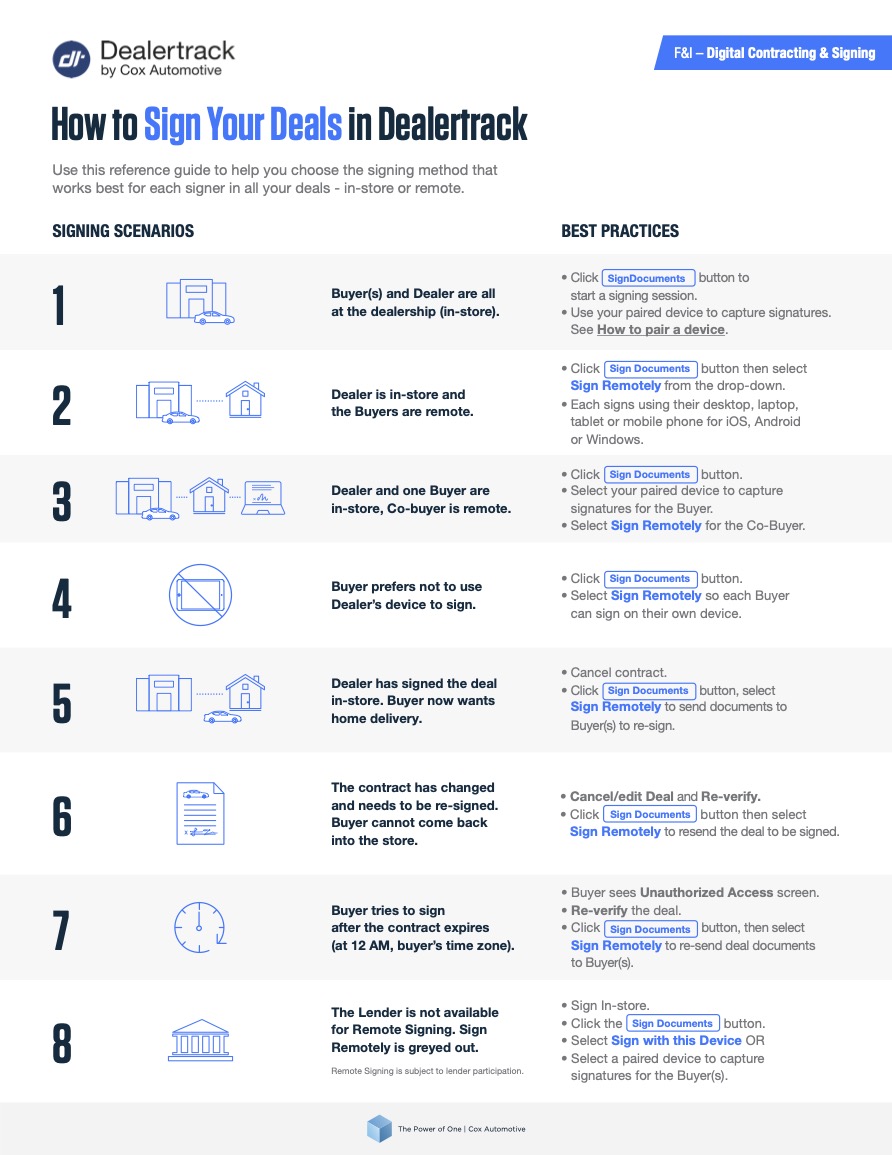

Between Sign Remotely, assisted Remote Signing, and signing in person at the dealership (in-store) – you have several signing option to choose from.

This easy-to-use visual guide presents 8 signing scenarios to enable you to quickly decide which to use for your deal. It also provides best practice recommendations plus the dos, don’ts, and tips for using in-store and remote signing.

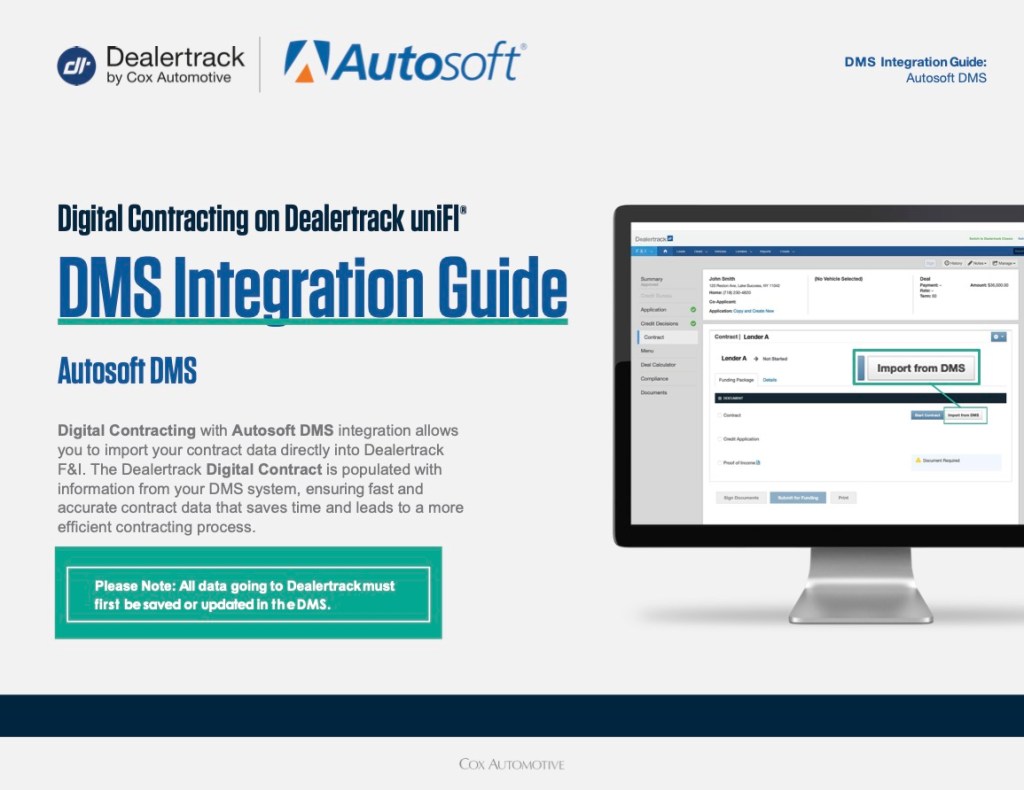

Follow our guide to learn how to import your deal into Digital Contracting from Autosoft DMS.

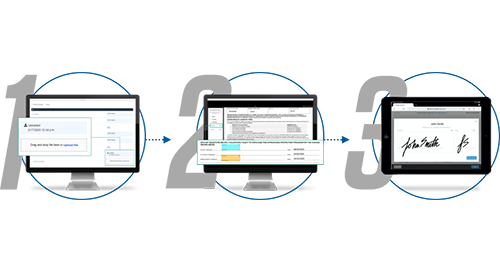

Follow our guide to learn how to import your deal into Digital Contracting from Adam DMS.

As dealerships seek ways to maximize efficiency and cash flow, many are taking a close look at their contracts in transit (CIT). Traditional paper contract packages spend an average of five days in transit according to Dealertrack data. They get packaged into an envelope and shipped to the lender, which means they can’t be reviewed – much less funded – until they’re delivered and opened.

That’s the best-case scenario. If the lender requires additional documents or there’s an error such as a missed signature that leads to re-contracting, the funding can get delayed further.

Here are five things your dealership can do to cut down on contracts in transit:

Tip 1: Know Where Your Contracts Are

Tracking your contract status is essential to finding out the scope of your funding delays. Make sure you have regular meetings and discussions with your F&I and back office teams about the number and dollar amount of contracts in progress that not yet funded and potentially holding up cash flow.

Make this information part of your daily heat sheet/CIT meetings with all teams to stay aware of your cash flow situation. Some dealerships have found that they can effectively manage their CIT by making it a part of each a team’s goals.

Tip 2: Look to Technology

Dealertrack data shows that one out of every four paper contracts contains an error such as missed signatures, contracts not meeting lender requirements, missing stips, and other errors that can lead to re-contracting and make the contracts in transit period longer than usual. In a recent survey of dealers, nearly 70% said that missed stips contribute to delays in funding or their CIT.

eContracting technology is designed with checks in place and built-in verifications to ensure that you can’t proceed without required information and signatures. It also reduces data re-entry by importing information from the DMS, so you can avoid accidentally introducing errors that can come from re-typing.

Another big advantage to taking your contracts digital is that you save money, not only by making the contracting process faster, but also by reducing hard costs such as floor plan, shipping charges, and paper forms.

Tip 3: Keep Your Lenders Close

Get to know the requirements of your preferred lenders to help ensure that everything they need is included in the funding package the first time around. Make sure your support staff gets a checklist to help them gather the necessary documents for your lenders – or use a digital solution with an integrated checklist to remove the guesswork from the process.

We also recommend staying connected with your lender reps so you always know who to work with to address any funding that gets stuck in transit.

Tip 4: Start the Clock Sooner

To really optimize your processes, rethink when “contracts in transit” begins. Rather than starting the timer at the end of the day or the next day, look at integrating your front and back office processes to get the deal out the door before your customer drives off the lot.

Take advantage of technology to speed up stip collection: scanners, copiers or tablets can get the documents into your computer and ready to submit in seconds. Make it a goal to submit each funding package as soon as it’s ready and see how that helps speed your cash flow.

Tip 5: Get Your Whole Crew Involved

Funding should not be the F&I department’s responsibility alone. Provide access and visibility to your software solutions so that sales, F&I and the back-office staff can improve the dealership’s overall workflow efficiency, including speeding trade-in titling to keep from holding up that portion of the deal.

With all your staff trained on the software, checklists and equipment you use in the dealership, you can work as a team to support F&I to get deals finalized, submitted and funded. Be sure to establish a process for training new employees and make use of free online training sessions from OEMs, lenders and software providers.

Start Today

There’s no need to wait to start reducing contracts in transit. From optimizing internal processes to adopting technology solutions, your dealership can begin to overcome cash flow roadblocks now.

Leasing can be an attractive option for car buyers who enjoy the bells-and-whistles of a late model car but seek to keep their payments in check. Cox Automotive forecasts an overall lease penetration rate of 29% for 2021 – and the rate is often much higher for many top brands. So, handling lease deals is a task every dealership’s back office faces regularly.

The problem is that lease contracts are not as standardized as their retail counterparts and preparing them manually can be a complex and difficult process. Fortunately, lease contracts from many major lease providers can be handled electronically.

Here’s what to look for in an eContracting provider for lease deals:

The right eContracting solution should align the dealership’s workflow for retail and lease contracts and create a more efficient process across the board. Going digital with the lease contracting process can help make those transactions faster and more efficient for dealership staff and lease customers.

Digital Contracting with Dealertrack uniFI has DMS integration for lease available across many top DMS providers. Click to learn more and see the list of available DMS integrations!

Follow our guide to learn how to import your deal into Digital Contracting from Dominion DMS.

Follow our guide to learn how to import your deal into Digital Contracting from Tekion DMS

Give customers the flexibility to sign their deal in-store or remotely, all in one secure signing ceremony.

As more and more dealerships adopt eContracting, you might be wondering if now is the time for your dealership to look into getting or using an eContracting solution. The fact is, there’s no good reason not to use eContracting today for the growing list of lenders that currently accept it.

When you adopt and use eContracting with your current lenders, you benefit from more efficient workflows, fewer returned contracts and faster funding from those lenders. Each time an additional lender joins the platform, you’ll be ready to expand those efficiencies in your daily transactions.

Here are some of the many ways your dealership can benefit from using eContracting today: