Tag: eContracting

How to Set Up Your Tablet for eSigning In-Store

Top 5 Profit Drivers for Today’s Digital Dealer

At a time when more of the shopping, buying, and relationship building is taking place online, dealers are taking stock of their digital technology portfolio. Cox Automotive forecasts that half of all car buyers will engage with at least one digital tool during the purchase process—which could mean more profitability for your car dealership business. Paired with award-winning support and data continuity, backed by the security of an experienced partner, dealers are setting the stage for success with the following list of profitability drivers:

1. Performance Management

1. Performance Management

There are few experiences worse than signing a contract and watching a vendor disappear before the ink has had a chance to dry. A true dealership partner should be available when you need them (and often before) to see your business succeed. They should set performance benchmarks and goals — and then hold your team to them.

2. Five-Star Support

2. Five-Star Support

When you’re working with a trusted partner, having a good support system there when you actually do need it to minimize interruptions should go without saying. However, you should say it, and demand it, before you sign a contract. Take a look at the average response rates and customer satisfaction scores of any potential vendor you’re considering. Emergencies happen; what can you expect when things go south?

3. Easy-to-Use Technology

3. Easy-to-Use Technology

Complicated interfaces, multiple logins, a lack of available training resources, and redundant data entry are like the four horsemen of the apocalypse to your retention strategy. If you want to improve the morale of your staff, invest in technology that is easy to use and helps your people focus on building better customer relationships.

4. Digital Signing and eSignature Templates

4. Digital Signing and eSignature Templates

Maximize time savings for both your employees and your customers with the flexibility of technology that allows for digital signatures and digital document signing. Go one step further with technology that allows your team to save their most frequently used documents so they can quickly and easily pull these up for eSigning whenever they need to finalize a deal.

5. Save Costs and Speed Up Cashflow with eContracting

5. Save Costs and Speed Up Cashflow with eContracting

Dealertrack data shows that the average time in transit for paper contracts is five days. In the meantime, holding costs accumulate and cash flow is halted. When you switch to digital contracting, your dealership saves on physical labor and hardware costs such as printers, paper, shipping, and related materials. Plus, you could realize funding as quickly as the same day you submit your deal documents.

Your brick-and-mortar business isn’t going anywhere. But the digitization of the industry is bringing the consumer to you in new and exciting ways. Prepare for car dealership profitability with the precision tools, processes, and the right mindset to achieve success.

Set your dealership up for success today. Ask our team of experts for advice—learn more.

Drive Efficiency with Simple Dealership Best Practices

In the quest to stay compliant, competitive, and profitable, dealerships are investing heavily in technology to increase efficiency. But technology alone won’t build a more efficient business. Your managers, frontline employees, sales staff, and back office rely on workflows, data, and training to make their day-to-day work faster and easier. Consumer buying habits continue to impact how technology aids every touchpoint along the way. Building an efficient dealership takes the right technology, tools, and people processes to thrive. Not to worry, though. Taking a multi-faceted approach doesn’t mean your tactics need a major readjustment. As you continue to grow, you can leverage the following dealership best practices to drive efficiency.

Harness Rapid Connectivity with Integrations

There’s nothing less efficient than the frustrating pause, stop, start of technology that doesn’t connect. When your data flows seamlessly between your CRM and your DMS—and then into the F&I process—you not only save time and become a more efficient auto dealership, but you also keep your staff from jumping ship. The efficiency that comes from being able to push critical, secure information from one (previously siloed) step of the buying process also has an additional perk: a happier customer. This is important because the 2022 Cox Automotive Car Buyer Journey Study revealed buyers are more frustrated with the amount of time required to complete this process than in the previous year!

Use Technology to Cut Out Manual Processes and Workflows

You’ve probably heard this before, but it’s worth repeating that manual data entry is a time-suck. It’s not just inefficient, though. Faster deals lead to happy customers, while fewer paper forms reduce errors. So where should you start? Integrations between your DMS and F&I software help dealers save time by reducing the amount of information their staff needs to key in, ensuring their credit applications and contracts are accurate, and speeding up the contracting stage. (Dealertrack DMS integrated with Dealertrack F&I ensures up to 75% of data fields are pre-filled in credit applications.) These steps save you and your customers time at the point of sale, but there are other ways to reduce pesky manual tasks that chip away at efficiency.

Leverage Partners to Roll Out New Technology

Last, but definitely not least, when introducing technology to your team, you should do everything you can to reduce the overall loss of productivity caused by stress, anxiety, and frustration your staff endures. But you should never take this on alone. Having a trusted partner in your corner who advocates for change, ensures all team members are secure in their knowledge of the technology, and builds dealership operational processes that help you succeed is worth its weight in gold.

The automotive industry is complex—but building dealership best practices like the above into your technology investment strategy doesn’t need to be. You should look for vendor partners who can step up to the challenge with a proven track record for success. After all, your people, processes, and customers depend on it.

Find a technology partner backed by experience and a proven track record to bring efficiency and ease into your everyday business. Learn More.

Improve Your Dealership’s Digital DNA

This might be a familiar scene in your dealership: your customers have just test-driven their dream car, checked all the cool features, and are living on cloud 9. Then, out come the piles of paperwork with the long-winded contract review and tedious signing process, which ruins the vibe and the positive feeling they had about your dealership. However, you can keep their excitement and your dealership CSI scores going strong by speeding up the process with the right digital solutions.

With digital contracting, electronic signature, and remote signing, you can say goodbye to paper contracts and let your customers sign on the dotted line without the paper shuffle, and from the comfort of their couch. All this saves time upfront since customers can fill out fields, sign once, and then simply tap after that, and later on because it reduces the risk of errors.

GO DIGITAL TO SAVE TIME AND MONEY

Digital retailing and online credit applications let your customers build and customize their dream ride and their deal terms, and apply for financing from your website, while digital menu technology helps buyers select aftermarket and F&I options with ease.

Digital service invoices make life easier for you and your customers since they can be sent via email or text and customers can see exactly what they’re paying for. And everyone loves the convenience of online payments, whether it’s for parts and service, F&I products, down payments, or vehicle purchases.

Implementing these enhancements into your dealership’s digital DNA significantly improves dealership customer experience, streamlines operations, and boosts efficiency, providing your business with a surefire way to thrive in today’s competitive market.

Learn how Dealertrack’s solutions can deliver the exceptional dealership experiences your customers have come to expect.

Do you Have What it Takes to be a Forward-Thinking Dealer?

Forward-Thinkers Know How to Increase Dealership Efficiency

Modern dealerships work hard to stay competitive. Driving efficiency in your auto dealership is a long game, however, and many business owners struggle to embrace the right mix of new technology without sacrificing profitability. So, what are the tactics that set forward-thinking dealers apart? What makes them so rare—accounting for only 33% of total dealerships?

Watch this video to discover how forward-thinking dealers earn 64% higher net profit (vs. static dealers), but also increase dealership efficiency and deliver the ultimate customer experience.

Adopt the mindset and tactics that bring major operational gains. Get your copy of The Forward-Thinking Dealership ebook.

Get it Now

Source: 2022 Cox Automotive Forward-Thinking Dealership Study

How to Use Enhanced Signing

In this video, watch how you can seamlessly sign deal documents in Dealertrack, in-store or remotely, using one easy button with the new enhanced signing feature.

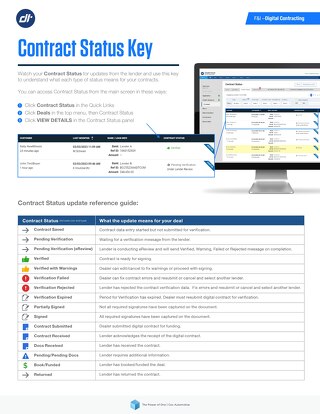

Contract Status Key Guide

Watch your Contract Status for updates from the lender. Download this quick reference guide for status updates and to understand what each type of status means for your contracts.

Six Ways it Pays to Go Paperless

When Earth Day comes around, it’s a good time to think about saving paper. But saving trees and doing good for the planet aren’t the only benefits of using less paper at your dealership.

If you’re using dealer software, you’re already familiar with the digital efficiency of submitting credit apps to multiple lenders with a click, accurately crunching deal numbers, signing deals on devices, or cutting down the wait for trade-in title release. But digital solutions also remove hassles associated with paper workflows and make your daily tasks easier to manage. Here’s how:

1. You can’t get a paper cut from a mobile device

Does anyone really enjoy printing and collating paper documents? It’s a lot of work and even when you do everything right, you’ll be presenting them to customers who immediately envision a case of writer’s cramp on the horizon when they just want to take their new vehicle and go.

If you made an error? Then you must start over and use up more time and paper.

And let’s not forget what those reams of paper cost! Record Nations estimates that the average business spends as much as $8,000 a year on paper.

Digital submission of credit apps and contracts can be handled on a tablet, so you don’t need to juggle stacks of paper to collect the information and signatures you need. No paper cuts, no writer’s cramp – just fast, efficient processes that help keep car buyers engaged in the excitement of their purchase.

2. We all remember the great toner explosion of 2019…

Printers and copiers can go from being useful tools to messy, annoying hindrances in an instant. Paper jams, the inability to connect to a data source, and mishaps replacing ink or toner cartridges can lead to frustrating downtime and delays for customers. Copiers and printers require expensive, often proprietary supplies, and service maintenance calls are even more costly. And printing checks often requires special equipment and more paper handling with mailing and stamps.

With digital processes, the war with printers is over. Online solutions allow you to submit credit apps, build funding packages, get electronic signatures, transfer trade-in payoffs via ACH, and connect securely to lenders – with no need to involve paper documents.

3. Valuable time and real estate

Did you know that a four-drawer file cabinet takes up an average of 9 square feet of floor space? That sounds like the beginning of an algebra problem, but think about what else your dealership could put in place of all the paper files you currently store.

Gartner research shows that every day, between 2% to 5% of an organization’s files are lost or misplaced. It takes an average of 18 minutes for an employee to locate a paper file and for misplaced files, the time spent jumps up to two hours! In contrast, digital files are securely stored in a customer’s digital deal jacket for easy, on demand access.

4. Keeping data out of the wrong hands

Speaking of secure storage, mishandling paper documents and files can compromise data security and expose your customers’ personally identifiable information (PII). For instance, if you forget to pick up a document from the copier or leave it out on your desk, anyone could pick it up and potentially misuse the information printed on it.

Digital solutions help keep your files password protected and available only to authorized staff members. And electronic transactions are encrypted and more secure than mailing or shipping paper documents, so sensitive customer data stays protected throughout the deal.

5. No need to get up

It’s easy for a customer to miss a signature in the haze of colorful sticky flags on stacks of paper forms. With digital signing, customers can review and sign once on a tablet or mobile phone, then simply click to apply the rest of the necessary signatures. They can do it on the lot, in the showroom, sitting in the vehicle they’re about to buy, or even handle deal completion from their home or office.

Dealerships can create full funding packages with an eContracting solution for uploading stips and deal documents, adding signature and date fields to create eSignable forms, and set up secure, single signing sessions for their customers wherever it’s most convenient for them.

6. Share and share alike

Waiting for another team to finish up with a paper folder and then having to track it down can really bog down your workflow. When you share folders digitally, it’s an automatic boost for team productivity and collaboration.

Streamlined workflows and easy access to information empower employees to work more efficiently and get more done without all the waiting around and digging through stacks of paperwork.

The bottom line

Switching to digital processes can save you up to $50 per deal on average1 – and approximately 52 sheets of paper per deal.2 Don’t let the inefficiency of paper deals impact your business – start adopting more digital credit applications, digital contracts, and electronic trade-in payoffs so you can maximize your savings!

Dealertrack has digital solutions to help reduce paper throughout your deal processes. Let us show you how. Get started >

1Savings estimates based on $50 savings from printing, shipping, and forms costs. Figures based on dealer calculations using Dealertrack’s Digital Contracting Calculator as of 2022. Not a guarantee of savings.

2Based on Dealertrack and dealer customer data as of August 2022

5 Things You Can Do To Speed Up Your Deals

Compared to manual F&I processes that involve paper forms and pens, digital deals are lightning fast. But there are things you can do to help ensure that you get more of your deals done quickly. Ilan Dee, Dealertrack Director of Product Management says, “Every enhancement made to Dealertrack’s Digital Contracting is done with the recognition that dealers need time and speed on their side to handle transactions more efficiently. We know this is especially important with a customer sitting right in front of you – that’s when those incremental time savings add up.”

We asked Ilan to share his top five tips for improving deal speed and here is what he recommended:

1. Use DMS import

DMS integrations help you save time by reducing the amount of information that needs to be keyed in and ensuring that you’re working with the same data set throughout the credit application and contracting stages of the deal. When you have Dealertrack DMS integrated with Dealertrack F&I, you get 75% of data fields pre-filled in the credit application. For contracts, Dealertrack DMS integration helps you go from import to submit for verification in less than a minute. Integrations with other DMS providers also give you a head start on quickly and reliably completing key fields for credit applications and contracts.

Ultimately, importing information from your connected DMS helps you avoid errors that can inconvenience your staff and customers and slow down funding.

2. Preset as many default values as you can

Many of your deals have common values for specific fields, for example Paid To and Charge Type for contracting. Work with your system administrator to pre-set contracting preferences that are likely to remain the same on most deals, including taxes, fees, and aftermarket products. This will reduce the time you spend manually entering this information – and you can still edit the field contents as needed.

3. Digitize your deal documents

To be able to submit a digital funding package, it’s important to digitize all documents and stips to avoid trailing documents that can delay the deal. Using a combination of Local File Upload and Point of Sale Capture, you can easily bring digitized documents into the funding package. Local File Upload lets you upload files directly from your computer, including email attachments that you’ve saved. With Point of Sale Capture you can use your tablet or mobile device camera to take high-quality images of stips and upload them directly into your deal jacket.

4. Save eSignature templates

To give customers the flexibility of eSigning, be sure to use the Ready Sign feature to add signature and date fields to make digitized documents eSignable. Maximize time savings by creating templates for your most commonly used documents. This will help you quickly and easily pull up those documents for eSigning whenever they’re needed for a deal.

5. Follow the Live Funding Checklist

One of your most powerful tools for building complete, accurate funding packages is the Live Funding Checklist. It includes many of the lender-specific forms and requirements for any given deal and helps guide you on where various documents should be uploaded. Based on continuous dealer feedback, this feature has been enhanced with highlights, asterisks, and a key so dealers know what the lender needs for submitting a complete funding package.

Myles Bauer, Financial Services Director for Muller’s Woodfield Acura, says, “Thanks to the Live Funding Checklist, we are up to date on our lender requirements and there are fewer mistakes in our contracting process.”

Fewer mistakes mean fewer delays in funding, which is one of the reasons that Dealertrack Digital Contracting can fund deals 83% faster* than with manual processes.

Want to know more? Visit our resource page full of information about faster contracting and funding.