Reduce data re-entry and import deal data directly from your DMS provider.

CDK Integration Guide

Reduce data re-entry and import deal data directly from your DMS provider.

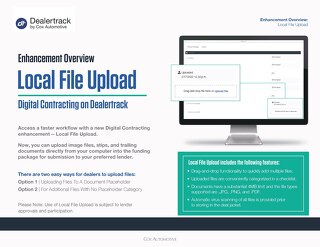

Access a faster workflow with a new Digital Contracting enhancement—Local File Upload.

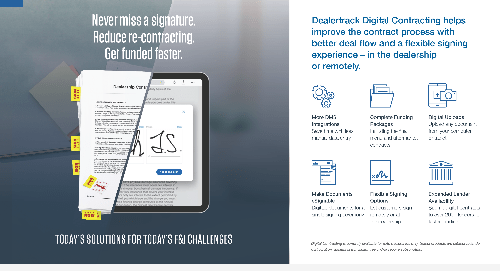

Streamline the signing ceremony through a paperless signing experience with Digital Delivery.

Still wondering if you should be using eContracting for your auto loan originations? Let’s examine some of the reasons lending institutions should already be using eContracting or digital contracting.

1. eContracting is the new standard

It’s no longer a matter of if you should be using eContracting: the industry has already hit the tipping point and it’s now a matter of when you’ll start trying to catch up with the early adopters. Lenders who use eContracting are already funding 2-3 days faster on every transaction and building dealer loyalty in the process. Which leads us to point #2…

2. Your dealers want eContracting

Dealers are adopting eContracting in record numbers and demanding that their lenders participate. In their efforts to counter margin pressure, dealerships are shifting their workflows to gain productivity and efficiency. They also value fast funding — and Cox Automotive dealer/lender research shows that it’s one of the top three reasons dealers choose a lender partner. Finally, there is customer demand for a faster and more efficient purchase process, which can be facilitated by eContracting and electronic signing.

As every lender knows, partnerships with dealers are measured by service, so helping your dealers improve their workflow and funding them as quickly as possible is exactly the kind of service that can help improve your relationships.

3. The paperless deal offers operational efficiencies

The industry is headed toward the paperless deal to improve efficiency and reduce overhead costs for dealers and lenders alike. eContracting can reduce days in transit from the dealer to the lender from an average of five days to just one, and its built-in accuracy features can help reduce returned contracts and re-contracting by 80%.

The paperless deal saves dealers from having to reprint forms that change, eliminates shipping costs, and allows for digital document storage that frees up office space while helping to keep forms available in case of audit.

Taking another evolutionary step further, going paperless leads to enabling lights-out funding. With eContracting doing the validations and eContracting producing electronic documents, the next opportunity is to use technology to auto-fund contracts the way loans are auto-decisioned today.

Want to learn all the reasons why now is the time to start eContracting with dealers? Join us at AFSA on Thursday, February 13th where Andy Mayers takes the stage to discuss Digital Contracting during the Technology Advancements program—or stop by booth #104.

Lose the paper, and gain the business – digital contracting optimizes review and approval for funding as fast as the same day.

Understand the benefits of Digital Contracting on Dealertrack.

In the year 2000, Tiger Woods became the youngest golfer to win a career Grand Slam, the original Mini ceased production, and the U.S. passed the E-Sign Act (Electronic Signatures in Global and National Commerce) ensuring that electronic signatures can be valid and legally binding.

Even though more than 20 years have passed since then, confusion about the legality of eSignatures remains. In this post, we’re going to work on clearing up some of the common misconceptions around electronic signatures.

Federal Laws Regarding eSignatures

The E-Sign Act states that a contract or signature, “may not be denied legal effect, validity, or enforceability solely because it is in electronic form”. Basically, the E-Sign Act gives eContracts and eSignatures the same legal standing as paper records. It also says that electronic records count as information “provided in writing,” as long as a consumer agrees to conduct their transaction using electronic means.

The E-Sign Act also requires lenders to keep accurate and complete electronic records that can be accessed and reproduced as needed by people who are authorized to access them.

You can click here to read the E-Sign Act if you want to know exactly how it’s stated.

In 2010, provisions of the Uniform Electronic Transactions Act (UETA) helped ensure that each state aligned on recognizing the legality of electronic contracts for business and commercial transactions. As of August 2021, New York State has not adopted UETA, but they have other laws recognizing electronic signatures for lenders.

But What About California?

When California adopted UETA, it made an exception for auto signing. However, California later adopted E-Sign, which supersedes UETA. Currently, every major provider and lender includes California in their eContracting platform.

Please consult your lawyer if you have doubts or questions about the legality of eSigning in your state.

What Are the Advantages of eSigning?

Giving electronic contracts and signatures the same legal status as their paper counterparts offers significant benefits for dealers, customers and lenders:

How Widespread is eSigning?

Industry-wide, lenders have purchased, securitized and funded billions of dollars in eSigned retail and lease contracts to date in all 50 states.

Are All eSignatures the Same?

Dealertrack eSignatures are accepted by all major lenders participating in eContracting on our platform in every state. In addition, there are aspects of our technology and signing process that help ensure eSignature authenticity and provide the authoritative copy of each contract in ways that some other providers do not. We can also offer a better customer experience with “tap and sign” functionality that allows buyers to sign one time per signing session and have all subsequent signatures pre-fill with just a tap.

If you’d like to learn more about the advantages of Dealertrack Digital Contracting, please click to request a demo.

The car buying process is getting more digitally connected with each passing year, yet most dealerships are still finalizing purchase contracts on paper. During this time when contract processing is a hybrid of traditional and paperless, it’s still possible for lenders to take some steps that will help them prepare for fully digital contracting.

The value of digital contract processing is easy to understand when you consider the extensive handling and manual data entry that lenders must undertake to process paper contracts. It can take days or even weeks from the time these contract packages ship out from the dealership before they make their way through lender review and approval for funding.

Dealertrack Digital Document Services provides a great solution to bridge the gap between paper and digital for lenders and speed funding. Take a look:

Savvy lenders understand that faster funding is the name of the game for supporting their dealer customers’ need for cash flow to help them stay profitable.

Utilizing Dealertrack as a technology partner helps lenders avoid the time-consuming tasks involved with data entry, validation and storage of paper contracts. Lenders gain efficiency to fund faster and keep dealers coming back for more.

To learn more, download The Lender Guide to Faster Paper Contract Processing.