Tag: digital contracting

How to Set Up Your Tablet for eSigning In-Store

How to Use Enhanced Signing

In this video, watch how you can seamlessly sign deal documents in Dealertrack, in-store or remotely, using one easy button with the new enhanced signing feature.

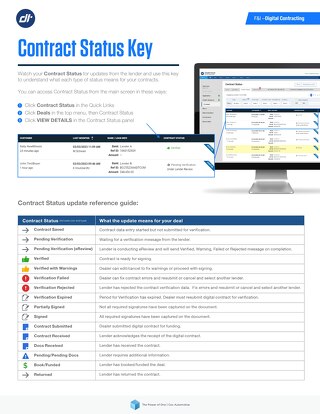

Contract Status Key Guide

Watch your Contract Status for updates from the lender. Download this quick reference guide for status updates and to understand what each type of status means for your contracts.

Six Ways it Pays to Go Paperless

When Earth Day comes around, it’s a good time to think about saving paper. But saving trees and doing good for the planet aren’t the only benefits of using less paper at your dealership.

If you’re using dealer software, you’re already familiar with the digital efficiency of submitting credit apps to multiple lenders with a click, accurately crunching deal numbers, signing deals on devices, or cutting down the wait for trade-in title release. But digital solutions also remove hassles associated with paper workflows and make your daily tasks easier to manage. Here’s how:

1. You can’t get a paper cut from a mobile device

Does anyone really enjoy printing and collating paper documents? It’s a lot of work and even when you do everything right, you’ll be presenting them to customers who immediately envision a case of writer’s cramp on the horizon when they just want to take their new vehicle and go.

If you made an error? Then you must start over and use up more time and paper.

And let’s not forget what those reams of paper cost! Record Nations estimates that the average business spends as much as $8,000 a year on paper.

Digital submission of credit apps and contracts can be handled on a tablet, so you don’t need to juggle stacks of paper to collect the information and signatures you need. No paper cuts, no writer’s cramp – just fast, efficient processes that help keep car buyers engaged in the excitement of their purchase.

2. We all remember the great toner explosion of 2019…

Printers and copiers can go from being useful tools to messy, annoying hindrances in an instant. Paper jams, the inability to connect to a data source, and mishaps replacing ink or toner cartridges can lead to frustrating downtime and delays for customers. Copiers and printers require expensive, often proprietary supplies, and service maintenance calls are even more costly. And printing checks often requires special equipment and more paper handling with mailing and stamps.

With digital processes, the war with printers is over. Online solutions allow you to submit credit apps, build funding packages, get electronic signatures, transfer trade-in payoffs via ACH, and connect securely to lenders – with no need to involve paper documents.

3. Valuable time and real estate

Did you know that a four-drawer file cabinet takes up an average of 9 square feet of floor space? That sounds like the beginning of an algebra problem, but think about what else your dealership could put in place of all the paper files you currently store.

Gartner research shows that every day, between 2% to 5% of an organization’s files are lost or misplaced. It takes an average of 18 minutes for an employee to locate a paper file and for misplaced files, the time spent jumps up to two hours! In contrast, digital files are securely stored in a customer’s digital deal jacket for easy, on demand access.

4. Keeping data out of the wrong hands

Speaking of secure storage, mishandling paper documents and files can compromise data security and expose your customers’ personally identifiable information (PII). For instance, if you forget to pick up a document from the copier or leave it out on your desk, anyone could pick it up and potentially misuse the information printed on it.

Digital solutions help keep your files password protected and available only to authorized staff members. And electronic transactions are encrypted and more secure than mailing or shipping paper documents, so sensitive customer data stays protected throughout the deal.

5. No need to get up

It’s easy for a customer to miss a signature in the haze of colorful sticky flags on stacks of paper forms. With digital signing, customers can review and sign once on a tablet or mobile phone, then simply click to apply the rest of the necessary signatures. They can do it on the lot, in the showroom, sitting in the vehicle they’re about to buy, or even handle deal completion from their home or office.

Dealerships can create full funding packages with an eContracting solution for uploading stips and deal documents, adding signature and date fields to create eSignable forms, and set up secure, single signing sessions for their customers wherever it’s most convenient for them.

6. Share and share alike

Waiting for another team to finish up with a paper folder and then having to track it down can really bog down your workflow. When you share folders digitally, it’s an automatic boost for team productivity and collaboration.

Streamlined workflows and easy access to information empower employees to work more efficiently and get more done without all the waiting around and digging through stacks of paperwork.

The bottom line

Switching to digital processes can save you up to $50 per deal on average1 – and approximately 52 sheets of paper per deal.2 Don’t let the inefficiency of paper deals impact your business – start adopting more digital credit applications, digital contracts, and electronic trade-in payoffs so you can maximize your savings!

Dealertrack has digital solutions to help reduce paper throughout your deal processes. Let us show you how. Get started >

1Savings estimates based on $50 savings from printing, shipping, and forms costs. Figures based on dealer calculations using Dealertrack’s Digital Contracting Calculator as of 2022. Not a guarantee of savings.

2Based on Dealertrack and dealer customer data as of August 2022

More Power to You with eSigning

How digital signing gives your dealership the versatility to improve service for a variety of customers

Over the past several years, Digital Contracting with eSigning has become a valuable way for dealerships to provide elevated service to address a variety of consumer needs. Whether a customer is patient or hurried, in the dealership or remote, there’s an eSigning scenario to help them complete their deal the way they prefer.

See how many of your customers you recognize!

Ready to Go

This customer has done their test drive, completed their negotiations, and just wants to drive off the lot as soon as possible. The last thing they want is a pen in their hand and a big stack of paperwork in front of them. With eSigning, the process is finished much more quickly.

Says Max Tiraboschi, finance manager at Foundation Automotive of Wichita Falls, “eSigning is at least 30 minutes faster than paper: you sign once, then tap to sign the rest of the documents. It helps us finish on a high note and gives our customers a better experience at the point when they’re ready to sign and go.”

Down the Road a Ways

For dealerships with rural or otherwise distant customers, remote signing can help enable off-site delivery. A truck buyer working from sunup to sundown during harvest season might not know that his deal documents could be sent with a click of button and delivered securely via email for him to view and sign on his mobile phone, but he will certainly appreciate it!

In Two Places at Once

There are lots of reasons that a signer and co-signer might not be able to meet up to finalize the deal. A parent may co-sign for a kid away at college, working couples may have challenges scheduling time off at the same time, or a co-signer might just be under the weather the day the deal gets finalized. In any of these situations, remote signing comes to the rescue. Each person can sign on their own device with no need for special arrangements or shipping paperwork that can delay deal completion.

Security Conscious

With high-profile data breaches in the news, it’s understandable that many consumers are extra cautious. For car buyers who are concerned about the safety of their personally identifiable information (PII), eSigning offers reassuring security features, beginning with the legally required eSign Disclosure and Consent. Whether it’s an emailed link with multifactor authentication for remote signing or secure device pairing in-store, eSigning is designed to encrypt data and limit access to it. The dealership also has access to an audit trail of the signing for additional protection.

Comprehensive Reader

A car buyer doesn’t have to be an attorney to want to read and understand each document before signing. But many customers may feel rushed by the experience of signing manual paperwork. Both in-store and remote eSigning give customers the opportunity to hold the signing device and read through the digital documents at their own pace with less pressure.

Physical Challenges

eSigning can be helpful for a customer who has challenges reading “fine print” or repeatedly signing on paper. According to Jonathan Bowling, variable operations director at Liechty Automotive Group, “Most of our customers love it because you only have to sign your name a handful of times rather than signing a hundred times. Especially with our elderly customers, because they’re able to hold the tablet and actually zoom in and make those words bigger where they can read them. And that’s a huge benefit for them.”

The ability to enlarge the text can make the signing experience much easier for any customer – regardless of their experience with digital technology outside the dealership.

One and Done

It’s safe to say that no customer wants to have to come back into the dealership to deal with a missed signature once they thought they were done. With eSigning, the signer literally cannot continue without each required signature being tapped into place, so it eliminates that problem altogether. According to Victor Hong, finance manager at Acura of Laurel, “We like having lender documents automatically generated for eSigning, and that it also shows you where to sign next, so you don’t miss signatures.”

Customers can be assured that they have completed their signing with the single ceremony, and there’s no risk for the dealership of damaging CSI scores with the last-minute hassle of needing one more signature or having to re-contract.

Making the Most of eSigning at Your Dealership

Ultimately, eSigning demonstrates to customers that your dealership is up to date with the latest technology and that you care about their convenience. Make eSigning part of your daily workflow by having tablets paired and ready each morning for in-store signing and enabling remote signing for customers who can use it.

If you need additional guidance to make the most of eSigning opportunities to benefit your customers, download Best Practices Guide for eSigning and Dos, Don’ts and Tips for Signing Your Deal to keep handy for reference.

5 Things You Can Do To Speed Up Your Deals

Compared to manual F&I processes that involve paper forms and pens, digital deals are lightning fast. But there are things you can do to help ensure that you get more of your deals done quickly. Ilan Dee, Dealertrack Director of Product Management says, “Every enhancement made to Dealertrack’s Digital Contracting is done with the recognition that dealers need time and speed on their side to handle transactions more efficiently. We know this is especially important with a customer sitting right in front of you – that’s when those incremental time savings add up.”

We asked Ilan to share his top five tips for improving deal speed and here is what he recommended:

1. Use DMS import

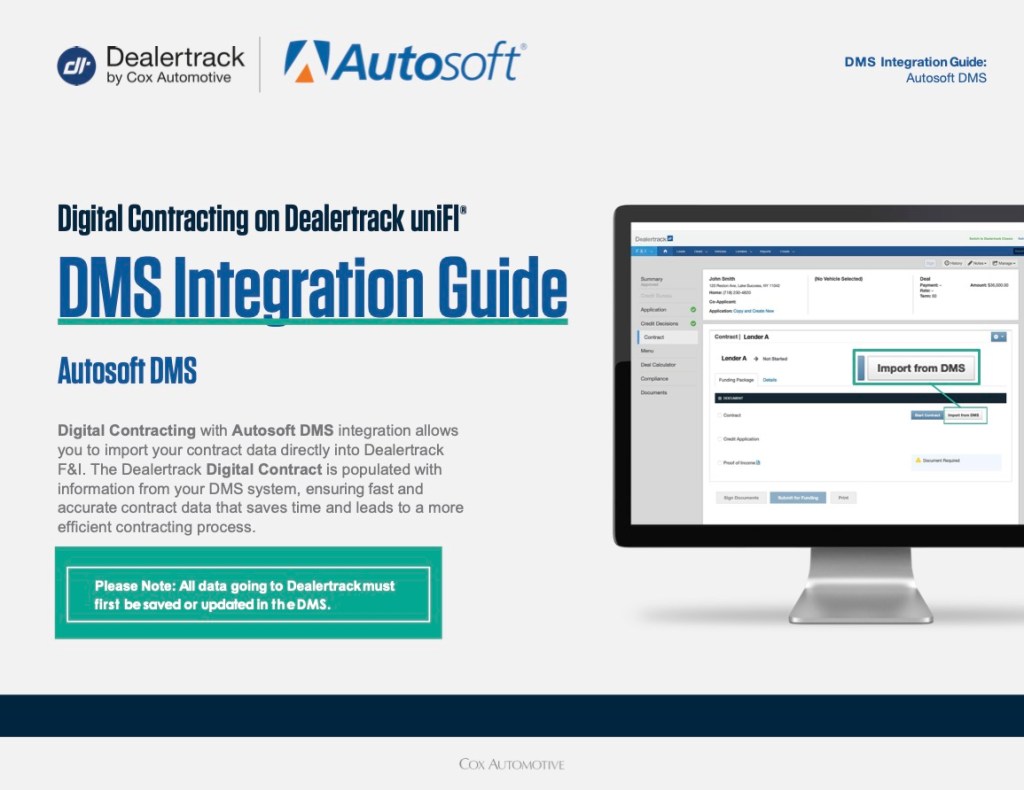

DMS integrations help you save time by reducing the amount of information that needs to be keyed in and ensuring that you’re working with the same data set throughout the credit application and contracting stages of the deal. When you have Dealertrack DMS integrated with Dealertrack F&I, you get 75% of data fields pre-filled in the credit application. For contracts, Dealertrack DMS integration helps you go from import to submit for verification in less than a minute. Integrations with other DMS providers also give you a head start on quickly and reliably completing key fields for credit applications and contracts.

Ultimately, importing information from your connected DMS helps you avoid errors that can inconvenience your staff and customers and slow down funding.

2. Preset as many default values as you can

Many of your deals have common values for specific fields, for example Paid To and Charge Type for contracting. Work with your system administrator to pre-set contracting preferences that are likely to remain the same on most deals, including taxes, fees, and aftermarket products. This will reduce the time you spend manually entering this information – and you can still edit the field contents as needed.

3. Digitize your deal documents

To be able to submit a digital funding package, it’s important to digitize all documents and stips to avoid trailing documents that can delay the deal. Using a combination of Local File Upload and Point of Sale Capture, you can easily bring digitized documents into the funding package. Local File Upload lets you upload files directly from your computer, including email attachments that you’ve saved. With Point of Sale Capture you can use your tablet or mobile device camera to take high-quality images of stips and upload them directly into your deal jacket.

4. Save eSignature templates

To give customers the flexibility of eSigning, be sure to use the Ready Sign feature to add signature and date fields to make digitized documents eSignable. Maximize time savings by creating templates for your most commonly used documents. This will help you quickly and easily pull up those documents for eSigning whenever they’re needed for a deal.

5. Follow the Live Funding Checklist

One of your most powerful tools for building complete, accurate funding packages is the Live Funding Checklist. It includes many of the lender-specific forms and requirements for any given deal and helps guide you on where various documents should be uploaded. Based on continuous dealer feedback, this feature has been enhanced with highlights, asterisks, and a key so dealers know what the lender needs for submitting a complete funding package.

Myles Bauer, Financial Services Director for Muller’s Woodfield Acura, says, “Thanks to the Live Funding Checklist, we are up to date on our lender requirements and there are fewer mistakes in our contracting process.”

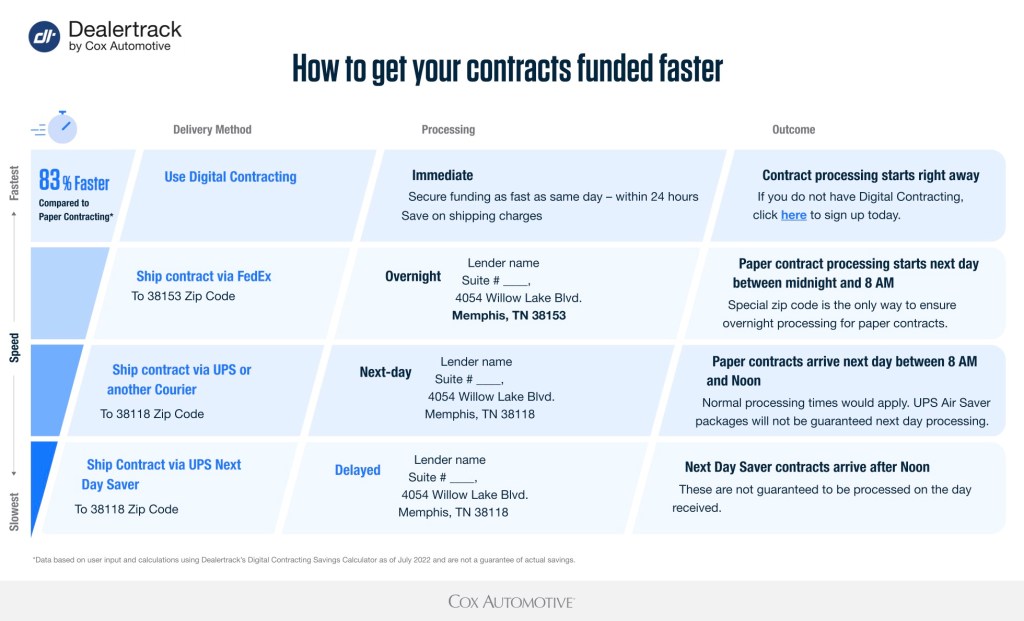

Fewer mistakes mean fewer delays in funding, which is one of the reasons that Dealertrack Digital Contracting can fund deals 83% faster* than with manual processes.

Want to know more? Visit our resource page full of information about faster contracting and funding.

How to Get your Contracts Funded Faster

Reference this document to ensure the best method is used across your dealership to ensure paper contracts are processed as fast as possible to speed funding.

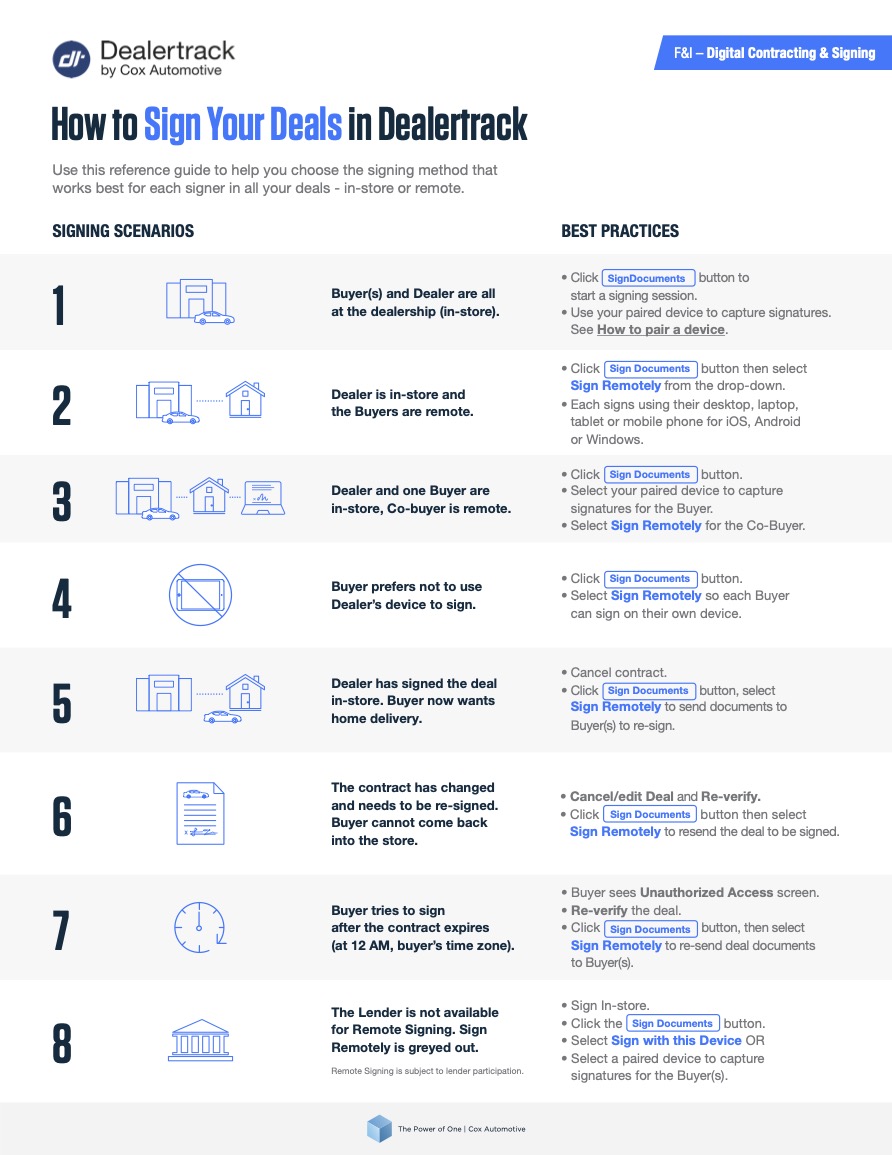

Best Practices Guide for Signing

Between Sign Remotely, assisted Remote Signing, and signing in person at the dealership (in-store) – you have several signing option to choose from.

This easy-to-use visual guide presents 8 signing scenarios to enable you to quickly decide which to use for your deal. It also provides best practice recommendations plus the dos, don’ts, and tips for using in-store and remote signing.

Digital Contracting DMS Integration Guide – Autosoft

Follow our guide to learn how to import your deal into Digital Contracting from Autosoft DMS.