AI is changing the way customers buy cars—and with it, you can exceed your customers’ expectations. Deal Central, Cox Automotive’s AI-powered deal making solution, equips you to deliver a connected, intelligent buying experience. And you don’t want to wait: Here are five steps you can take today to build a better experience, based on research from Cox Automotive’s Digitization Study.

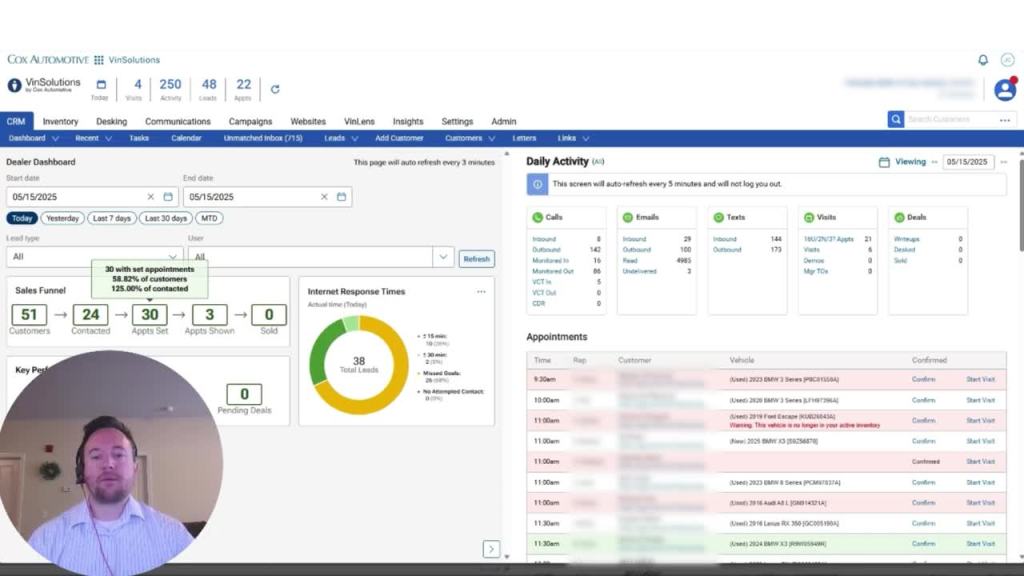

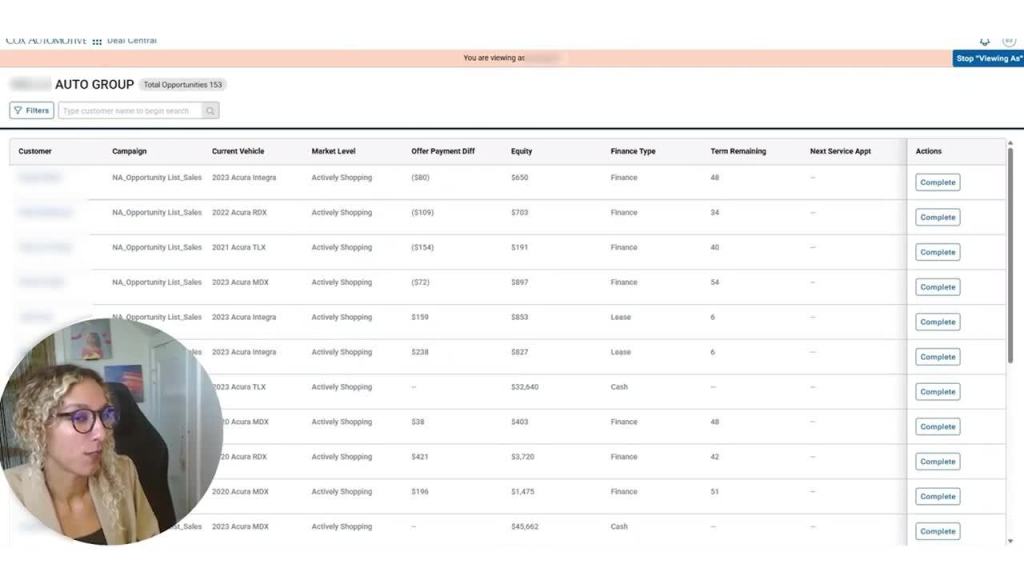

Tip 1: Use Deal Pulse to Present the Right Offer the First Time

Take Action

Train your managers to utilize real-time data and insights to better understand customer leads and budget expectations.

Why it matters

Some deals are direct and straightforward, with buyer and dealer on the same page throughout the entire deal process Other deals take a more roundabout route, with negotiations and offers going back and forth. These back-and-forths often result in one side feeling less satisfied with the result and the deal-making experience.

Having real-time insights into deal activity enables you to monitor shopper progress and assess interest levels, helping you keep every deal moving forward. With this data-driven approach, you can present offers that better align with shopper expectations from the beginning, which reduces negotiation time and leads to higher close rates. With Deal Pulse, your team can instantly see which deals are gaining traction, identify shoppers who may need additional support, and proactively adjust offers based on real-time engagement—ensuring every opportunity is maximized and no deal is left behind.

Tip 2: Empower Your Sales Reps to Work Deals Side-by-Side with Customers

Take Action

Encourage your sales team to work side-by-side with customers to build deals together—both in the dealership and online.

Why it matters

customer A connected, tech-driven buying experience is key. Plus, your customers are craving transparency—to be on the same page with the same information as you—throughout the entire deal process.

As much as you can, when you deliver an experience with less back and forth, you’re simply building that trust between customer and dealer that makes all the difference. Deal Central is designed to bring shoppers and dealers together for a connected, transparent, tech-driven experience—whether online, in-store, or anywhere in between.

Tip 3: Automate Your Credit and F&I Workflows

Take Action

Leverage automation features to streamline credit applications and F&I paperwork.

Why it matters

It’s all about reducing friction in the deal process and bringing buyer and dealer together for a mutually beneficial deal. While ordinary deal processes usually include some amount of wait time in between applications, approvals, and paperwork, successful dealers are using automation to reduce or eliminate traditional sticking points. When shoppers submit details online, they trust that their information goes directly to your team. Now, 83% of buyers expect a continuous deal experience—without having to repeat the same questions or information once inside your store. Meeting this expectation with streamlined, automated workflows not only enhances customer satisfaction but also helps close deals faster.

Automation gives your sales reps and managers the tools they need to work faster and smarter. It reduces manual entry, minimizes errors, and ultimately saves time for you and your customers—especially in the F&I office, where delays often frustrate buyers.

Tip 4: Personalize Every Deal with Real-Time Shopper Data

Take Action

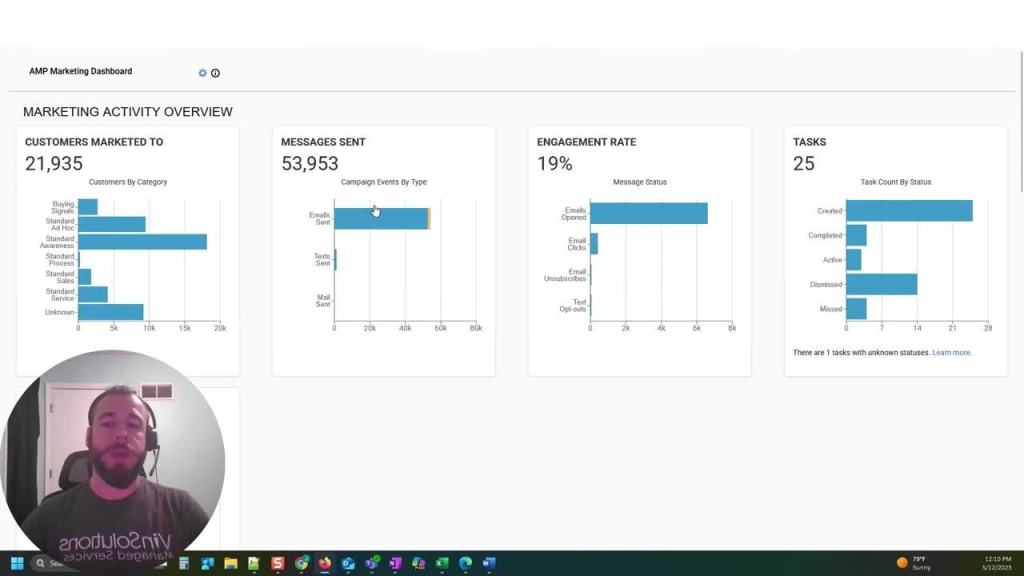

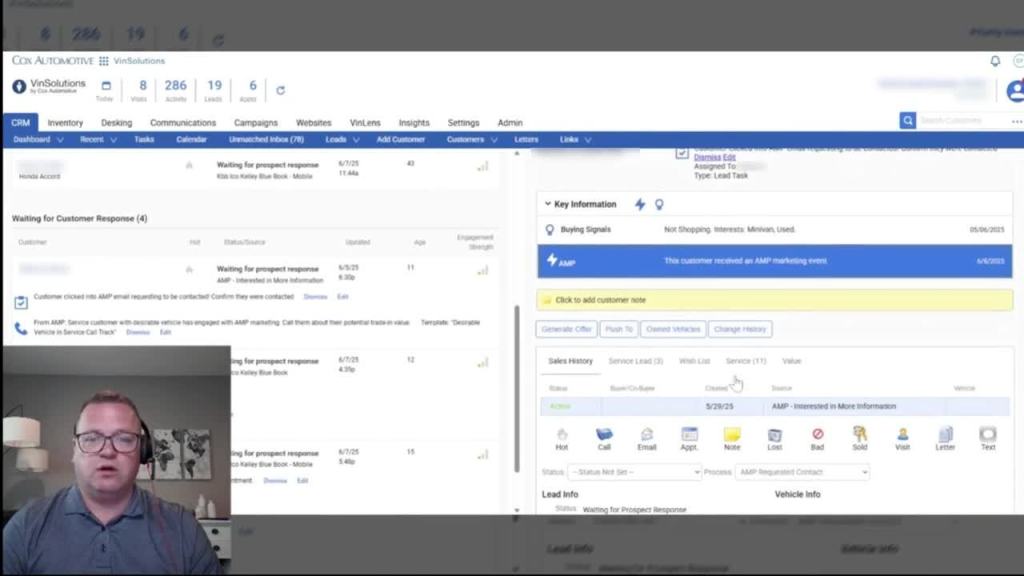

Use AI-driven insights to tailor offers, communications, and follow-ups based on each shopper’s behavior and preferences.

Why it matters

Shopper engagement is always the goal—in every deal. If you can engage shoppers in conversations about new or used cars, get them interested and invested in the possibility of a new purchase, that potential customer is more likely to buy, and more likely to buy from you.

Powerful AI and automation helps you know what customers are interested in so you can create custom offers based on their behaviors. Deal Central also delivers a seamless, connected deal from start to finish—empowering you to pick up with shoppers wherever they left off—so you can keep engagement strong and avoid losing shoppers due to lack of interest.

Tip 5: Create a Seamless Omnichannel Experience

Take Action

Ensure your team is trained to support deals that start online and finish in-store (or vice versa).

Why it matters

The growth of omnichannel retail and self-guided shopping has empowered customers to move effortlessly between online and in-store experiences. This level of convenience has become the new standard. In fact, shoppers now expect it across every retail interaction—car buying included.

Deal Central connects the entire deal process and gives shoppers the seamless experience they seek out. As they begin to build deals online, Deal Central saves progress, so shoppers can pick up right where they left off, no matter where they choose to shop. This type of connected experience not only benefits the customer, omnichannel dealerships see a 53% higher positive impact on close rates and save an average of 42 minutes per deal.

AI is the new standard for buying and selling cars. Learn more from our latest guide: The AI Advantage: The Digital-First Guide for Dealerships.

Start building better deals today. Learn more about Deal Central and sign up for a demo to maximize every deal for you and your customers.

Source: Cox Automotive’s 2024 Digitization of Retail Study