Dealers are leaning into digitization. And the results are here. According to the 2024 Cox Automotive Digitization of Automotive Retail Study, omnichannel dealers are outperforming their peers across key metrics like close rates, customer satisfaction, and gross profit. That’s big news for the industry and great news for your dealership.

Below is a list of the top five trends from the data that are reshaping dealership success you simply can’t afford to ignore.

AI Adoption is Key

The data: 49% of omnichannel dealers use one or more AI capabilities, compared to just 32% of other dealers.

With AI no longer just a buzzword, you’re free to use it to your advantage. Nearly half of the study’s omnichannel dealers are leveraging AI to streamline operations, personalize shopper experiences, and optimize deal flow. These dealers are using predictive analytics to identify high-intent leads, automate follow-ups, and tailor offers based on real-time consumer behavior. This level of intelligence allows sales teams to work smarter, not harder, focusing their energy on the deals most likely to close. By integrating AI into their digital retailing strategy, top-performing dealers are gaining speed, precision, and control over the sales process, ultimately driving higher profitability and customer satisfaction.

Kelley Blue Book (KBB) VIN-specific pricing recommendations and Instant Cash Offer (ICO) leverage AI and real-time market data to help dealers identify high-intent shoppers, personalize offers, and close deals with confidence. When integrated into a broader digital retailing strategy, these tools help dealers align with shopper expectations while maintaining operational control and transparency.

Digital Retailing Technology Drives Efficiency and Satisfaction

The data: 70% of dealers agree that online retailing tools create efficiencies and improve customer satisfaction.

Embracing digital retail technology can help you streamline your operations and deliver a better experience for both your shoppers and your staff. Online retailing tools make it easier to connect with your customers at every stage of the car buying journey—whether online, in-store, or somewhere in between. By automating routine tasks and gaining a unified view of shopper activity, you reduce friction, save time, and empower your sales teams to focus on building relationships and closing deals. The result: higher customer satisfaction, increased efficiency, and more profitable dealership.

Kelley Blue Book® Instant Cash Offer (ICO) and Price Advisor tools integrate seamlessly with digital retailing platforms, giving dealers real-time, market-reflective values and transparent pricing that shoppers trust. These tools support a more consistent and trusted experience, helping dealers deliver a more efficient experience that builds confidence and drives repeat business.

Omnichannel Dealers Outsource More, Win More

The data: Omnichannel dealers outsource an average of 4.8 online retailing capabilities, compared to 4.0 for other dealers.

Outsourcing digital retailing capabilities lets you scale your business and stay ahead of changing consumer expectations. By partnering with trusted technology providers, you can focus on building relationships and closing deals, while experts handle the complexities of online retailing. This approach gives you access to best-in-class tools, reduces operational burden, and helps you deliver a seamless experience across every channel.

Kelley Blue Book® Instant Cash Offer offers a scalable way to bring consistency and credibility to the trade-in process. By embedding trusted, third-party valuations into omnichannel workflows, dealers can reduce friction, enhance transparency, and deliver a more unified experience—whether online or in-store.

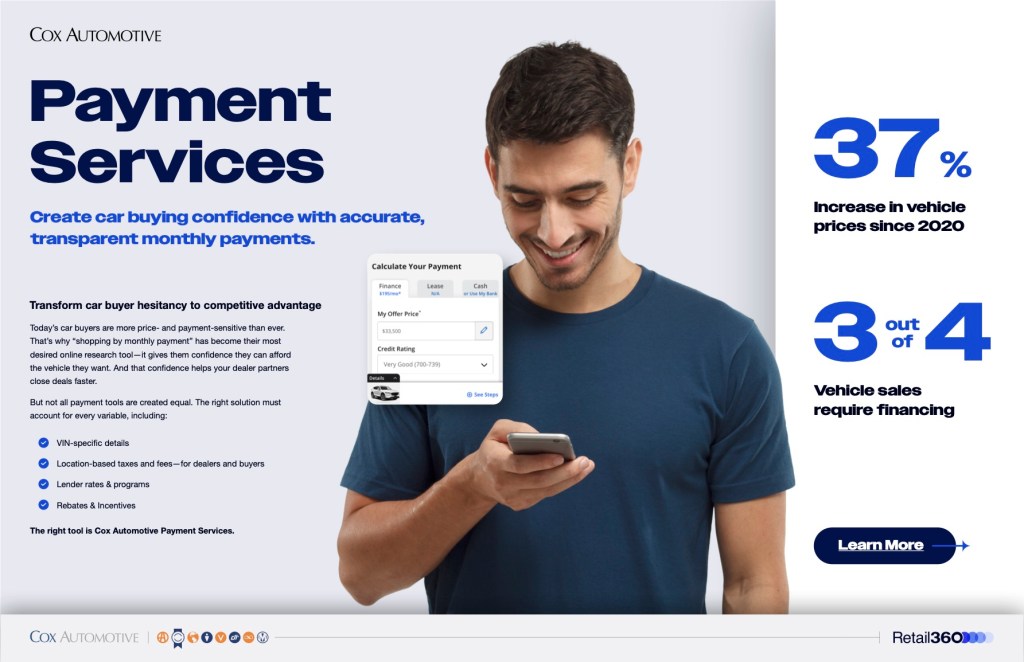

Digital Retailing Boosts Close Rates

The data: Omnichannel dealers see 53% more positive impact on close rates from digital retailing than other dealers.

Digital tools help you respond quickly to buyer inquiries, personalize the experience, and remove barriers that slow down the sales process. When you streamline workflows and leverage real-time data, you create a seamless path to purchase that gets buyers to “yes” faster and more often.

Tools like Kelley Blue Book ICO and Price Advisor help bridge the gap between shopper intent and dealer action. By integrating with your digital retailing strategy, you can build confidence at every step, accelerate deal-making, and convert more leads into closed sales.

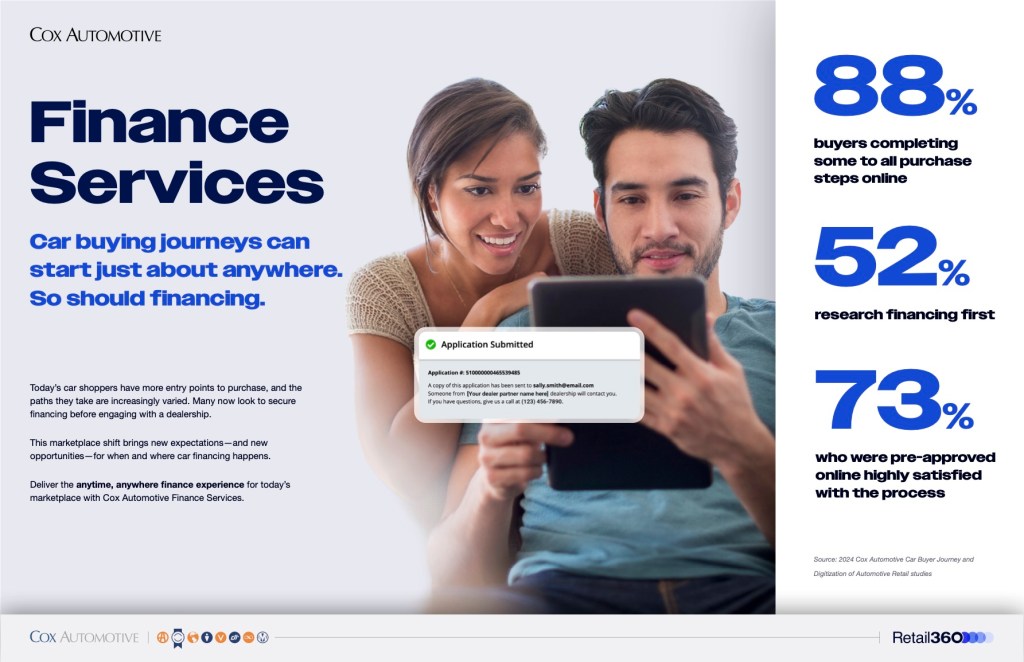

Automation is Reshaping F&I and Credit Apps

The data: Dealers using automation save 42 minutes at the dealership for mostly digital car buyers compared to light digital buyers.

No more manual data entry, reduced errors, and accelerated approvals sound like a dream come true? That’s the goal. Automation empowers your team to focus on delivering a seamless, transparent experience for every customer. When you streamline these critical steps, you not only save time but also create a more efficient and profitable workflow for your dealership.

Kelley Blue Book Instant Cash Offer (ICO) integrates into F&I and digital workflows—bringing automation to valuation and trade-in processes. This not only reduces manual effort but also supports a more transparent and efficient experience for today’s digitally minded car buyers.

Ready to Embrace AI and Automation?

AI, automation, and digital retailing are no longer optional—it’s essential for driving efficiency, satisfaction, and profitability. Dealers who leverage these technologies are streamlining operations, building trust with shoppers, and closing more deals, faster. As the retail landscape evolves, Kelley Blue Book continues to serve as a trusted source of data and insight—helping dealers navigate complexity, build trust, and deliver experiences that resonate with modern car buyers.

Ready to see how KBB can help you outperform the competition? Request a demo today and discover the difference trusted data and seamless technology can make for your business.

Source: 2024 Cox Automotive Digitization of Automotive Retail Study