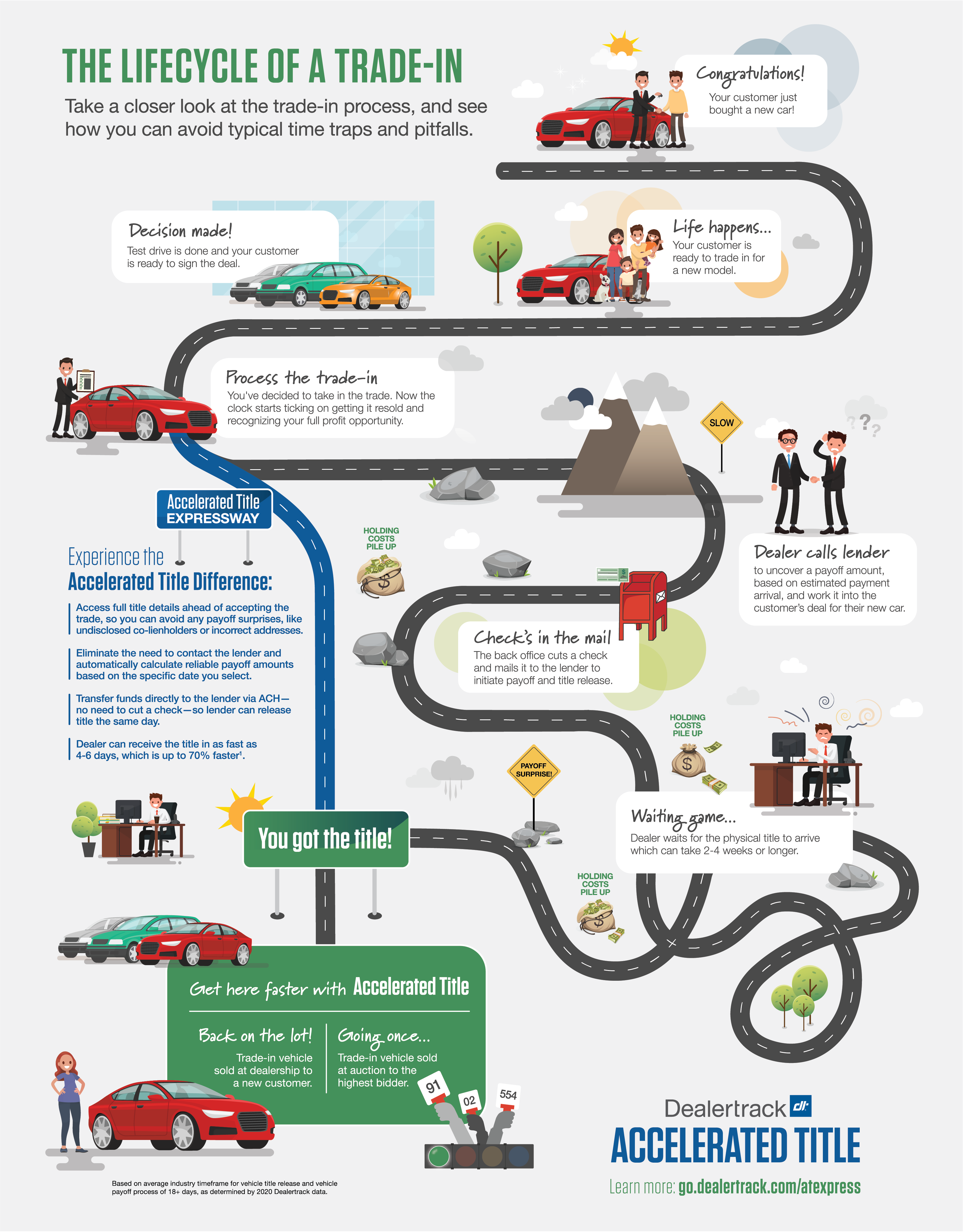

Under the current market conditions, with new car inventory at historic lows, dealerships’ used car programs are more important than ever as a revenue and cash flow source. That puts increased focus on your dealership’s trade-in process, both for replenishing used car inventory and enticing car buyers to upgrade.

Now the challenge is to ensure that you have all the information you need to keep the deal moving smoothly.

The more you know…

Let’s say someone brings in a trade-in vehicle with great resale potential and they’re eager to purchase another vehicle from you. The customer tells you that nothing has changed with their name or address since they bought the car and they’re the only person listed on the title.

What you don’t know is that the title actually lists an old address – and the customer’s former spouse as the co-lienholder.

With manual processes and paperwork, that kind of revelation could take a while to surface and when it does, there’s a chance that your dealership could be stuck with a vehicle it can’t legally sell. At the very least, it will create extra work and hassle for you and your customer. At worst, it can cause the deal to unravel and leave you with the fallout if you’ve sold the trade to someone else or sold a new car to the customer who brought in the trade, valued with the vehicle they brought in.

When your dealership has access to a digital trade-in title solution, you can view all the title details immediately. That way, if there’s a potential problem you can begin to work it out with the customer then and there, before you even accept the trade. Having the information you need up front helps ensure smoother transactions and preserve your CSI scores.

Payoff perspective

Another manual trade-in process that can bring its own surprises is loan payoff. Having complete and reliable payoff information is important for desking clean deals. It also cuts down on time-consuming back-and-forth with the lender if you need to make adjustments.

A digital trade-in titling solution provides direct lender connections for real-time payoff quotes based on the payoff date and allows for immediate title release as soon as the lender receives payment.

Keeping cash flow moving

Why is all this important? Because delays in payoff and title release equal delays in cash flow. While the dealership waits for the title on a trade-in, holding costs accumulate and the potential for retailing or auctioning the vehicle is held back. The sooner you can have the title in hand, the quicker that cash flows into your bank account.