Automotive digital marketing and avocados have something in common – both have fairly short “Best By” consumption timeframes, where something that recently seemed new is suddenly past its prime.

The lesson here for dealers: don’t let your automotive web design and curated user experience gather dust. With more consumers doing more online than ever before, they have high expectations with their shopping experience.

From browsing inventory and researching a model, to submitting a lead and reviewing your customer service, there are several points along the buying journey where you can differentiate your dealership and keep your customers coming back for more. Read on for 3 ways your dealership can differentiate the digital experience you offer shoppers, keeping them engaged while delivering more value to your business.

- Support Meaningful Conversations

Your dealership website offers a lot of information to consumers. Equally important, these pages collect highly valuable first-party data for your future use, such as targeting in-market shoppers with display ads or video ads.

While retargeting ads have value, they offer one-way communication to consumers. In other words, they are marketing at people rather than conversing with them. As a dealer, you know how important person-to-person conversations are. So, how can you preserve shopper connections and support meaningful conversations?

Through 3rd party integration with LivePerson, Video Chat and CoBrowse are aimed at creating a more engaging environment for online shoppers with more interactive features. As the name describes, Video Chat enables consumers to chat with dealers over video, which can be initiated from the Digital Retailing application. A handy tool for reviewing details, CoBrowse lets shoppers share their screens with dealers while shopping, allowing dealers to guide consumers as if they were side-by-side in the showroom. Ultimately, you want to replicate a good one-to-one experience, but digitally.

- Provide Flexible Retailing Tools

Automotive digital retailing is not often described as a leisure activity. Until recently, this step might have been a bit daunting to shoppers, and the turning point where they would hop in their car and pursue assistance at the dealership. This is becoming less and less the case – partly due to environmental circumstances, and also because the tools are becoming more user-friendly.

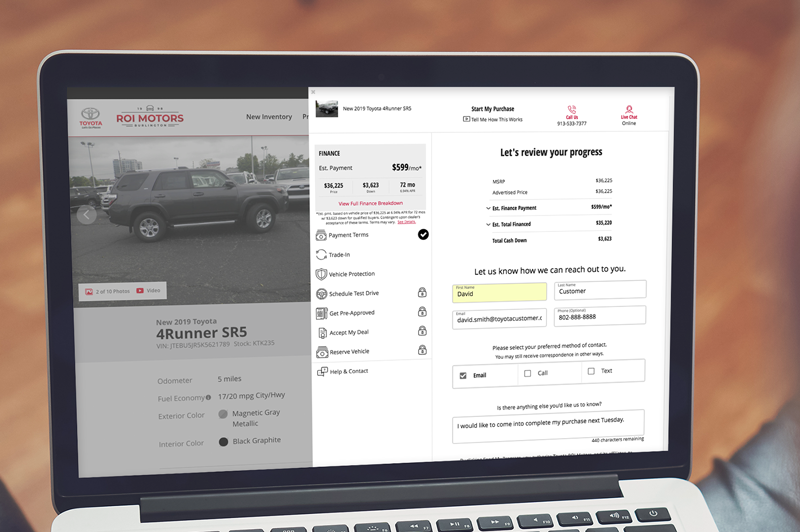

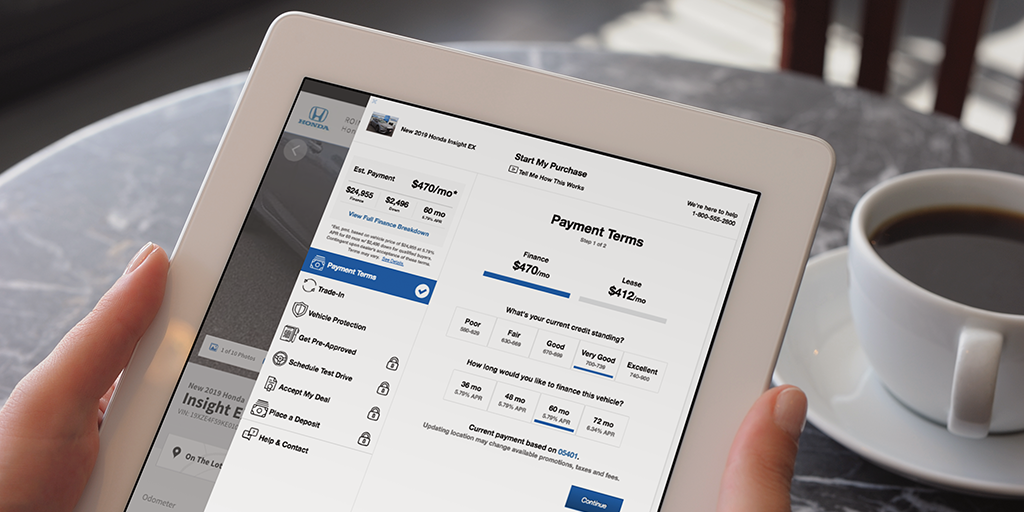

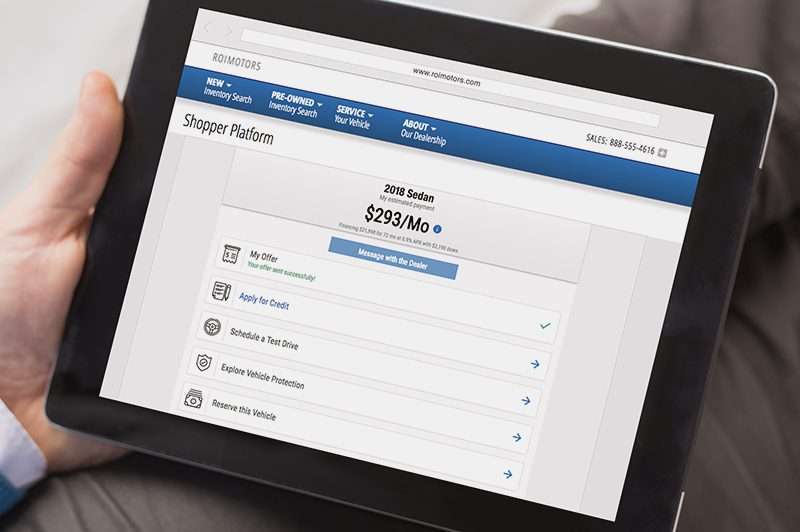

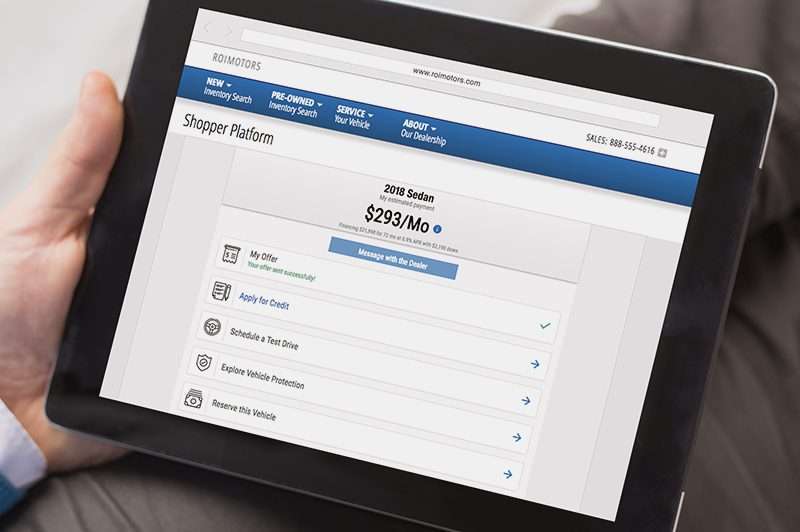

The latest digital retailing solutions turn this challenging process into simple steps, giving the consumer a bit of validation as they move forward. They also provide flexibility with how and when the lead form is completed. For example, a consumer may be missing some information and they can skip a step and come back to it, rather than running into a dead end.

Digital retailing of today is a self-driven and self-directed process. In other words, people want to be guided, but not forced. To keep people engaged and on the path toward submitting a deal, it is important to provide options for completing the form: pause for a break, get help, save it to edit later, etc. This flexibility translates to generating more automobile leads; a consequence of a consumer-first sales process, which is nothing new, but now it is digital-enabled.

- Build Trust Through Reputation

The saying goes that opposites attract, but not when it comes to recommendations for buying a car. When going through an important decision like this, people look for things they can relate to. More and more, consumers are looking for trust and the feeling of it within the automotive buying experience. This is where positive customer reviews can effectively tie a ribbon on your next deal.

One of the ways you can differentiate from your competitors and answer the question “Why buy from us” is by investing in reputation management for car dealers. Your best advocate is the person who just bought from you. By soliciting their goodwill through Review Generation, and helping other consumers see the perks of this transaction, you can convince other people to do the same.

A detailed review can be especially useful in building trust and illustrating the experience for a prospective customer. For instance, here are examples of superior customer service will score big points with consumers today: you offered to meet them wherever they were (i.e., for the test drive), made them feel safe, made the deal transparent, made things easy (deal signing, car delivery), and treated them like an individual.

It gives shoppers confidence to learn that you are going the extra mile to transact in the way they want. There is power and opportunity in public recognition that your business cares, and you can use the tools of reputation management to broadcast this message in an authentic voice.

From Websites and Digital Retailing, to Advertising and digital marketing services, Dealer.com solutions are built to connect consumers with dealers digitally. Let our team help you guide in-market shoppers through digital car-buying, dealership customer retention, and more.