In the big wide world of automotive advertising, co-op advertising remains a crucial strategy for dealers. Supported by OEMs, the shared advertising costs in co-op dollars allows dealers to promote their brands and engage customers. Some lovingly refer to it as “found money”.

However, you might be surprised to learn that not every dealer uses all of it’s OEM co-op advertising budget and dollars!

To help make sure you don’t leave money on the table, we’ve interviewed Autotrader’s own Michele Wright, Director of Sales, to discuss ways you can make the most of your co-op advertising dollars, especially as we step into the back half of 2024, and start to plan for 2025.

Her simple yet sage advice will help dealers ensure they’re maximizing their co-op advertising budgets and using the money, especially as advertising spending increases and the quest to stretch your dollars grows.

Increased Focus on Co-Op Advertising by Dealers

Q1: Can you share a bit about why you think co-op advertising has been, and will continue to be, such an important channel marketing strategy for automotive dealers?

Michele Wright: Co-op programs were created to help dealers extend their brand recognition and market reach. The best way to utilize these funds is to put your messaging in front of as many consumers as possible. OEM-approved co-op solutions are available for all brands that offer co-op, and you can use your co-op funds to cover up to 100% of advertising costs, depending on the manufacturer and the dealer.

One of the key reasons co-op advertising needs to be a focus—and considered a cornerstone of your strategy—is because it’s a “use it or lose it” situation. Some dealers don’t manage their co-op funds effectively and may not realize they could lose these valuable resources that are essentially free money.

Shifts in Co-Op Advertising Post-Pandemic

Q2: What are some of the things that have changed or shifted in the automotive industry when it comes to co-op advertising over the last few years post-pandemic, that supports why dealers need to really focus or re-focus on their co-op strategy?

Michele Wright: Co-op funds were not as readily available pre-pandemic as they are now. Overall ad spending during and after the pandemic declined, but co-op spending has seen a steady increase—about 13% in the last year, according to Russ Mann, Vice President of marketing at The Advertising Checking Bureau (ACB), which manages co-op programs for various industries, including automotive.

The auto industry spent about $12 billion on advertising last year, up from a low of $11.4 billion in 2022. This total is expected to hit $12.3 billion this year, according to the BIA Automotive Report 2024. New car inventory is back and starting to age, and dealer flooring costs are causing issues. High interest rates and high new car prices are obstacles dealers are facing.

Dealers need to start selling new car inventory as quickly as possible and work with their partners to get the right inventory for their lot. The best way to do this is to advertise. And co-op advertising dollars can help support this.

How Autotrader Can Help Dealers Maximize Co-Op Dollars

Q3: How is Autotrader helping dealers ensure they are making the most of their co-op dollars and not leaving any money on the table?

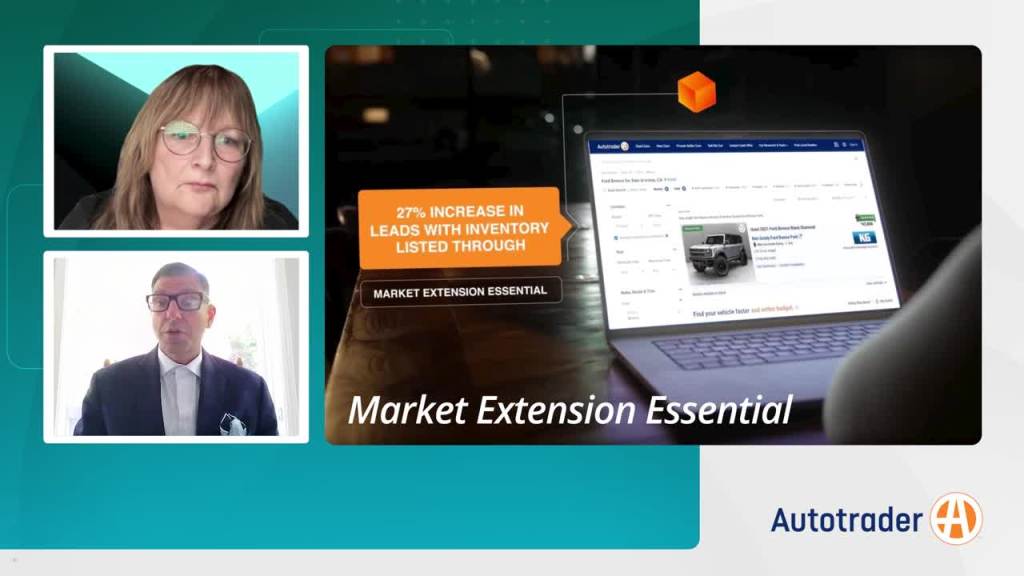

Michele Wright: Autotrader offers customizable co-op options to fit the needs of dealers, including advertising for new, certified, and used vehicles. Our listings and advertising solutions are eligible for co-op reimbursement through 17 OEMs, with reimbursements varying from 50% to 100%.

Our platform is easy to use, and we provide all the necessary documentation to submit to the OEM. Let me repeat that…. Not only is all the documentation provided to you and there for you to supply to your OEM, but it’s easy to use! The dealer partners I interact with say it’s like an “easy button”.

We also offer Autotrader-managed solutions that protect dealers from any infractions on our advertising. It removes that layer of worry or stress. Autotrader’s co-op program offers different service levels (Dealer Managed, Autotrader Managed, and OEM Managed) to help dealerships receive and provide the required documents set by the OEM for co-op reimbursement claims.

The Results Speak for Themselves

Q4: With Autotrader and Kelley Blue Book, especially with it being the #1 most used third-party automotive site to research and shop online, what type of results are dealers seeing using Autotrader’s listings and advertising solutions that are Co-Op eligible?

Michele Wright: Autotrader and Kelley Blue Book have the largest audience of in-market shoppers in the country. Utilizing co-op funds with a customizable solution from us gives you the most bang for your buck.

Dealers have seen significant improvements in their advertising reach and effectiveness, leading to increased sales and better inventory turnover.

“In times like today,

where costs are increasing but margins are shrinking,

the dealers that use all of their co-op dollars

are seeing more opportunities for their inventory to move.”

It’s Time to Build or Re-examine Your Co-Op Strategy

Q5: What should existing or prospective dealers do if they’d like to connect with Autotrader to take a deeper look at their current co-op strategy, to make sure they’re getting the most out of it?

Michele Wright: For current Autotrader franchise dealer partners—whether you’re using Autotrader co-op programs or not—connect with your rep to find out which of your Autotrader solutions are co-op eligible through your OEM and make sure you’re getting the most out of it. You might be surprised, there may be an opportunity to substantially increase your digital ad spend and effectiveness at no additional expense to you.

It’s your money, don’t leave it on the table. Request your Autotrader co-op eligibility consultation to ensure you’re not missing opportunities and making the most out of your dollars.

For dealers that aren’t currently partners with Autotrader, visit b2b.autotrader.com and click on the top right side where it says, “Get Started.” With Autotrader’s Co-op Assistance Program. It’s designed to take the complexity out of the compliance and reimbursement process.

By leveraging co-op advertising effectively, dealers can extend their brand reach, engage more customers, and ultimately drive more sales. Don’t let these valuable funds go to waste—make sure you’re maximizing your co-op dollars and leaving no money on the table.

“It’s never been easier and more cost-effective

to start advertising your inventory on

the most visited marketplace of ready-to-buy car shoppers.”

For the Road Forward:

Within the fiercely competitive domain of automotive advertising, co-op advertising has been, and will continue to be, a cornerstone of a successful channel marketing strategy for all automotive dealers. Co-op advertising, driven by OEM support, has proven time and time again to be an effective tool for dealers and channel partners to engage customers, promote brands, and make sales while sharing advertising costs.

As dealers move into the second half of 2024, they should ensure they’re maximizing their advertising budgets and not leaving any free money on the table. And Autotrader can help you find opportunities to get in front of shoppers that are ready-to-buy.

Autotrader provides you with qualified leads for people who want cars. We have the data that connects and activates your data, and we have the shoppers. We know what they want, and our goal is to match them with our dealer partners, driving quality leads that have the highest gross profit on average industry wide. We connect you with customers virtually, to move shoppers to you, so that you can focus on building and letting your brand shine.

Embrace the tips Michele Wright shared and ensure that you close out 2024 and enter into 2025 without leaving any co-op money on the table. When you maximize and take advantage of the customized Autotrader co-op opportunities in front of you, you’ll have the winning strategy to move more cars.