Used vehicle sales helped keep dealerships afloat during new vehicle inventory shortages in recent years, but they are expected to be flat this year as new vehicle sales rally. Cox Automotive Chief Economist Jonathan Smoke recently shared this projection in a 2023 Manheim Used Vehicle Value Index. His team also expects used vehicle values to begin recovering by the end of the year, based on year-to-date increases in the first quarter.

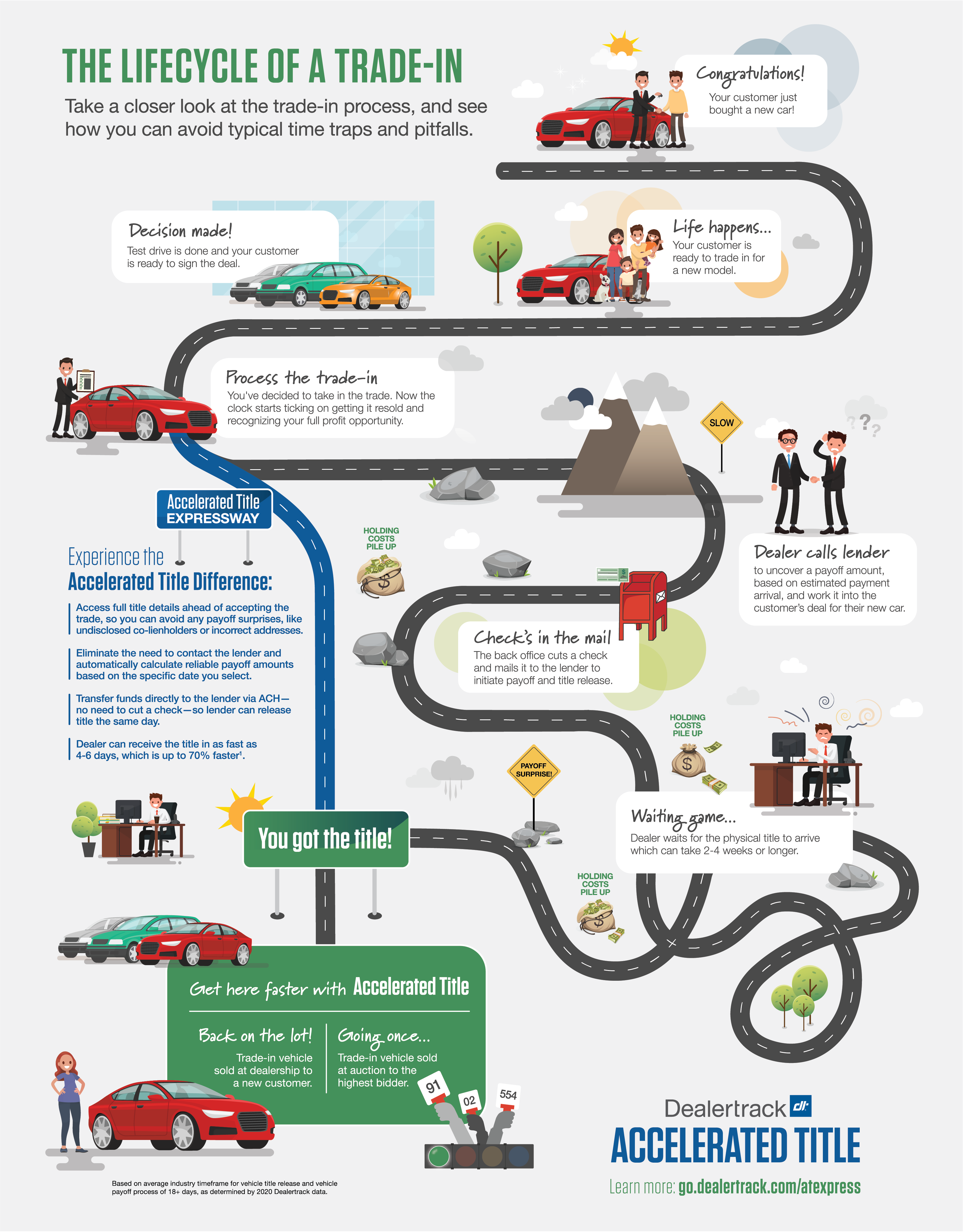

Whether used vehicles are leading sales for your dealership or playing a more supporting role, the way you handle trade-ins affects your profitability and cash flow. In any market conditions, optimizing trade-in payoffs and lien and title release can help you save on processing and holding costs and realize profits sooner.

Let’s look at five ways using a digital solution can help you plan for success and make the most from your trades:

#1 – Eliminate deal-killing surprises

When a trade-in comes to you without a title, you don’t know what you don’t know. There could be an ex-spouse or estranged parent listed who won’t approve the trade or can’t be reached. Before you know it, you’re facing unwound deals and bad feelings all around. Or inversely you may find yourself doing what other dealers do and turn away a potentially profitable trade due to the risk of there being a payoff surprise tied to the vehicle with no way of knowing what details reside on the title.

A trade-in titling solution lets you view an image of the paper or electronic title before you take in a trade. With all the facts in front of you, your dealership can work with the customer to solve any potential problems or choose not to accept the trade. Either way, you move forward with all the necessary information to make the decisions that are right for you.

#2 – Less painful payoff quotes

Does your ear feel warm just thinking about the time you spend on the phone to define what the trade-in payoff amount is? Do you hang up each call expecting that you may still have to deal with a short pay or overpay?

Using a digital trade-in titling solution gives you a direct online connection to top lenders for reliable payoff calculations specific to the lender and based on the date you choose.

#3 – No more checks in the mail

It’s probably been a while since you wrote a check at the grocery store. So why are you still cutting checks and shipping them to lenders? The entire process is surprisingly costly for dealerships, adding up to an average of a thousand dollars per month for a single rooftop.* The administrative work includes having to look up the correct remit address for the lender and making sure you verify the account number. It’s a lot of effort that could be handled with a press of a button using a trade-in payoff solution.

With all the routing information included on the back end, ACH payoff gets the payment to the lender immediately so processing can begin right away.

#4 – Title or lien sat release in hand faster

The longer it takes to get a trade-in vehicle’s paperwork transferred, the longer it sits idle on the lot costing you money instead of making money. On average, it takes 18 or more days to release a lien or title and in the meantime the vehicle is taking up a percentage of what you spend on dealership overhead costs. Expedited lien and title release cuts that processing time down by 70% when you use Dealertrack Accelerated Title®.**

#5 – Steady cash flow

It’s important to keep cash flow moving to power your dealership. The sooner you have the lien sat release or title in hand for a trade, the sooner you can sell it and realize fuller profits. Instead of letting holding costs add up and take away from your profits, speeding lien and title release means you can be re-selling the vehicle more quickly off your lot or at auction.

The bottom line

Streamlining your lien and title payoff and release processes can benefit your dealership regardless of economic trends. Take control of your operational efficiencies now to help make the most of your trades, even when times are uncertain.

Save money and get rewarded!

Throughout November 2023, use Accelerated Title and you can earn rewards and be eligible for grand prizes. Terms and conditions apply. Find out more here.

Sources:

*Dealertrack and dealer customer data as of August 2022. Not a guarantee of actual savings.

**Based on average industry timeframe for vehicle title release and vehicle payoff process of 18+ days, as determined by 2022 Dealertrack data.